In today’s fast-paced world, managing finances efficiently is crucial to achieving financial stability.

People are constantly seeking ways to save money, pay off debts, and develop better financial habits.

One innovative and engaging method gaining popularity is through “Savings and Debt Payoff Coloring Pages”.

These creatively designed coloring pages not only provide stress relief but also serve as a visual aid to help individuals track their financial progress.

In this blog, we will explore the benefits of using these coloring pages as a tool for managing savings and debt payoff.

What Are Savings and Debt Payoff Coloring Pages?

Savings and debt payoff coloring pages are specially designed with various illustrations representing financial milestones and goals.

You can color in each segment as they make progress towards saving money or paying off debts.

It’s a fun and interactive way to stay motivated while working towards financial freedom

The Psychology Behind Coloring Pages For Learning

Coloring has long been associated with relaxation and stress reduction. When combined with financial education, it becomes a powerful tool for reinforcing knowledge.

The act of coloring enhances focus and helps retain information better. It engages both sides of the brain, promoting a holistic understanding of the subject matter.

Benefits Of Savings and Debt Payoff Coloring Pages

1. Engaging Financial Education – Coloring pages make financial education enjoyable for both adults and children.

They transform complex concepts into engaging visuals that are easy to comprehend.

2. Visual Learning – Visual learning enhances memory retention and understanding.

By coloring the pages, individuals reinforce their grasp of financial concepts, making them more likely to apply these principles in real life.

3. Promotes Creativity – Coloring allows for creative expression, which can lead to innovative thinking when it comes to managing finances.

It encourages individuals to find unique solutions to their financial challenges.

4. Mindfulness and Stress Relief – Engaging in coloring activities promotes mindfulness and reduces stress.

Financial matters can be overwhelming, and coloring provides a therapeutic outlet for those anxieties.

5. Tracking Progress – Coloring pages with progress-tracking elements offer a tangible way to monitor financial achievements.

They serve as powerful motivators, encouraging individuals to stay on track with their goals.

How To Use Savings and Debt Payoff Coloring Pages?

Using savings and debt payoff coloring pages is simple and enjoyable.

First, find a collection online or create your own, then print or download them for easy access.

Next, choose pages that align with your financial goals, whether it’s emergency funds, debt payoff, or budgeting.

Grab your coloring tools and start filling in the pages while absorbing the financial concepts. Visualize your progress and track milestones using pages like debt trackers.

If using these with children, make it interactive and engaging, discussing concepts in relatable ways for better understanding.

Happy coloring and learning.

Best Savings and Debt Payoff Coloring Trackers

Our premade savings and debt payoff coloring trackers make your debt pay off journey easy, enjoyable, and rewarding.

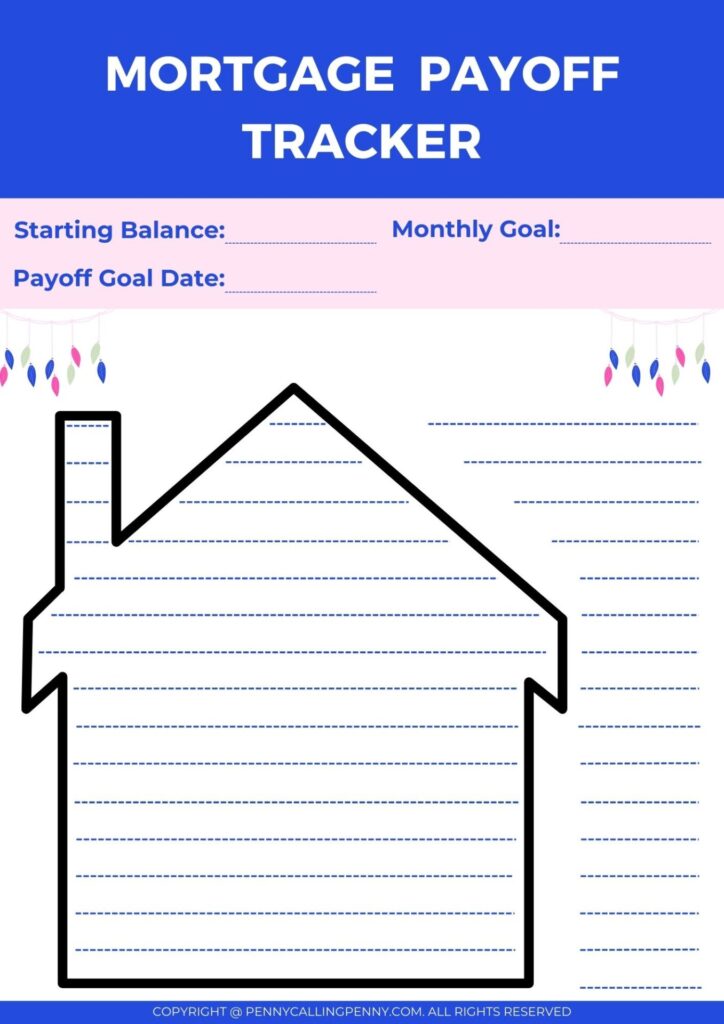

Mortgage Payoff Tracker: Celebrate Your Journey To Debt-Free Homeownership

This mortgage payoff tracker is for all of you aspiring homeowners out there.

It’s a coloring page designed to help you pay off your mortgage faster and achieve the dream of owning your home outright.

By tracking your mortgage payments and coloring in each milestone, you’ll feel motivated and empowered to see your mortgage balance shrink.

Imagine the satisfaction of coloring that last payment and owning your home free and clear!

How To Use:

Each time you make a mortgage payment, color in a section of the house.

You can use a different color for each payment or milestone.

As you color in more sections, you’ll see your progress towards debt-free homeownership.

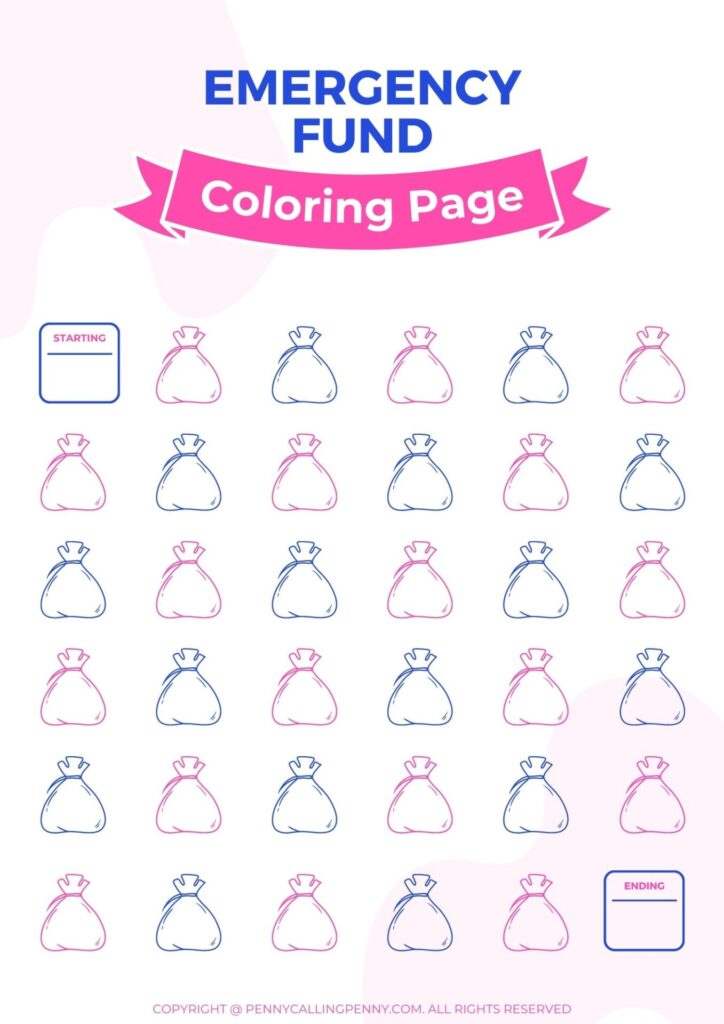

Emergency Fund Coloring Page: Building A Safety Net, One Color At A Time

This emergency fund coloring page is for anyone who wants to create a financial safety net for unexpected expenses or emergencies.

Life is full of surprises, and having an emergency fund is like having a shield against financial storms.

Coloring this page will remind you of the peace of mind that comes with knowing you have a fund to fall back on when life throws curveballs.

How To Use:

Each time you add money to your emergency fund, color in a section of the money bags.

The coloring sheet will help you visualize your growing safety net and motivate you to continue saving for emergencies.

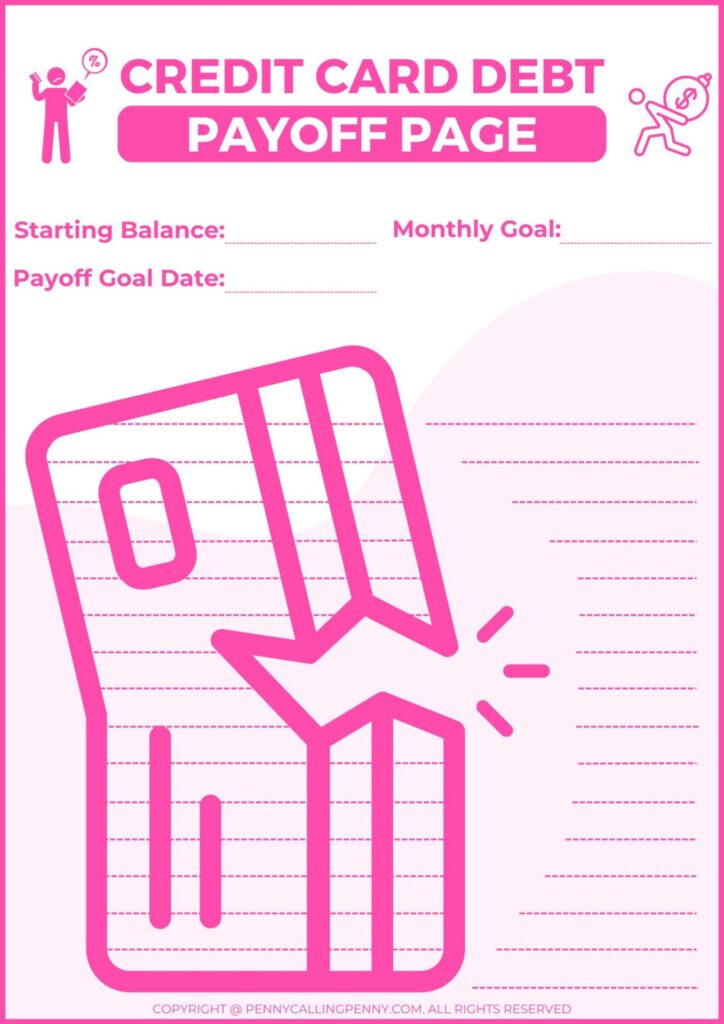

Credit Card Debt Payoff Page: Color Your Way To Financial Freedom

This coloring page is dedicated to those battling credit card debt and wanting to break free from its clutches.

Credit card debt can be a vicious cycle, but this coloring page will motivate you to take charge of your finances.

It’s a creative way to stay focused on paying off your credit cards debt and gaining control over your financial future.

How To Use:

Every time you make a credit card payment, color in a section of the credit card template.

As you color in each credit card, you’ll feel a sense of accomplishment and determination to be debt-free.

$1000 Savings Challenge: Level Up Your Saving Game

The $1000 savings challenge is for those looking to jumpstart their savings and create a financial cushion.

Saving money can be challenging, but this coloring page turns it into a fun and rewarding experience.

You’ll see how small steps add up to significant savings, motivating you to continue building healthy financial habits.

How To Use:

Color in each icons as you save money towards each milestone. You can use different colors or stickers for each level completed.

The coloring sheet will turn saving into a fun and rewarding challenge.

Financial Vision Board: Turn Dreams Into Reality With Colors

The financial vision board is for anyone wanting to manifest their financial dreams and visualize their ideal future.

A vision board can be a powerful tool for achieving your goals.

By combining it with coloring, you’re making the manifestation process even more engaging and enjoyable.

How To Use:

Print the template and use magazines or online images to cut out and paste pictures representing your financial dreams.

Color in the decorative elements with vibrant colors. The finished board will serve as a powerful visualization tool for your financial aspirations.

Student Loan Payoff Journey: Coloring Your Way To Debt Freedom

This coloring page is dedicated to students or graduates working towards paying off their student loans.

Student loan debt can feel overwhelming, but coloring this page helps you focus on the progress you’re making and envision a debt-free future.

How To Use:

Each time you make a student loan payment, color in each cap.

As you color in more caps, you’ll visualize your progress towards becoming debt-free.

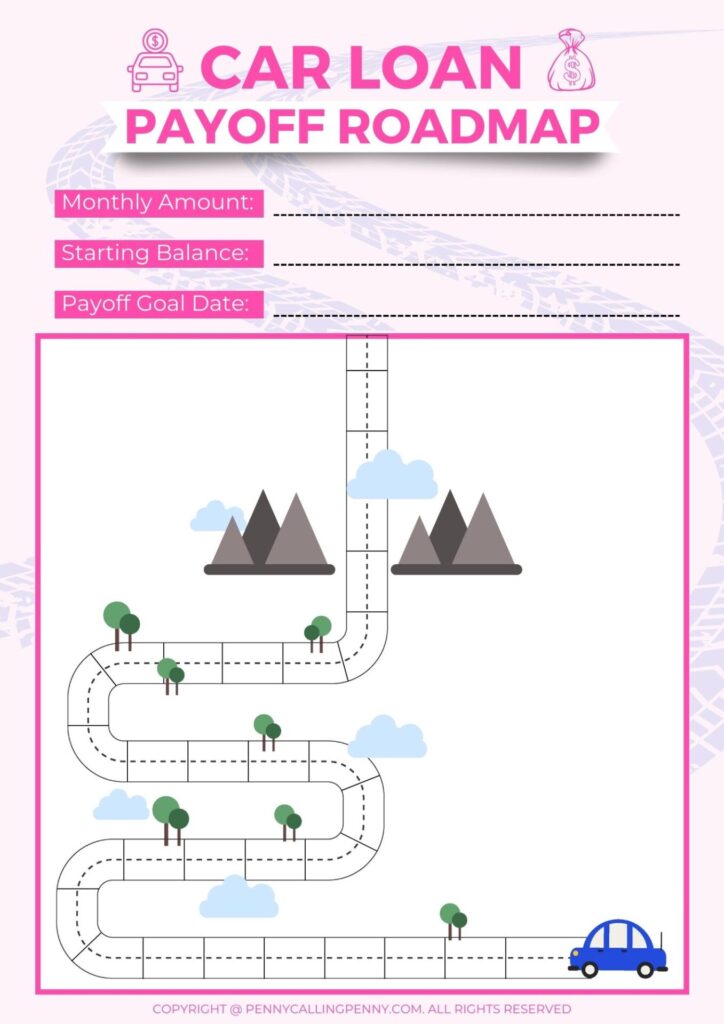

Car Loan Payoff Roadmap: Speeding Towards Financial Victory

The car loan payoff roadmap is for individuals striving to pay off their car loans and own their vehicles outright.

Being free of car loan debt means more money in your pocket each month.

This coloring page adds excitement to the process and reminds you of the financial freedom you’re working towards.

How To Use:

Each time you make a car loan payment, color in a section of the roadmap.

As you approach the finish line, you’ll feel motivated to accelerate your efforts towards debt freedom.

Financial Freedom Challenge: Coloring Your Journey To Independence

The financial freedom challenge is for those who want to take charge of their finances and achieve true financial independence.

Financial freedom means having the freedom to make choices based on your values, not just financial constraints.

This coloring challenge will inspire you to take steps towards financial autonomy.

How To Use:

Color in each section as you achieve each financial milestone.

As you climb the financial mountain or ladder, you’ll be inspired to keep progressing towards financial freedom.

Debt-Free Journey Diary: Documenting Your Path To Debt Freedom

The debt-free journey diary is a mix of a traditional diary and a coloring book, designed to track your emotions and progress while paying off debt.

The debt-free journey can be emotional, and this diary allows you to express yourself creatively while sharing your achievements and challenges.

How To Use:

Use the diary to document your daily or weekly financial journey. Write about your financial wins, challenges, and lessons learned.

Use colors to highlight key moments or emotions. This diary will serve as a treasured keepsake of your debt-free journey.

Family Savings Goals: A Coloring Adventure For The Whole Family

This family-oriented coloring page is all about setting and achieving financial goals together.

Teaching kids about money and setting savings goals as a family fosters healthy financial habits and promotes open communication about finances.

How To Use:

Gather the family and discuss your shared financial dreams and savings goals.

Each time the family contributes to a goal, color in a section of the coloring sheet together.

The coloring sheet will foster communication and teamwork while working towards common financial aspirations.

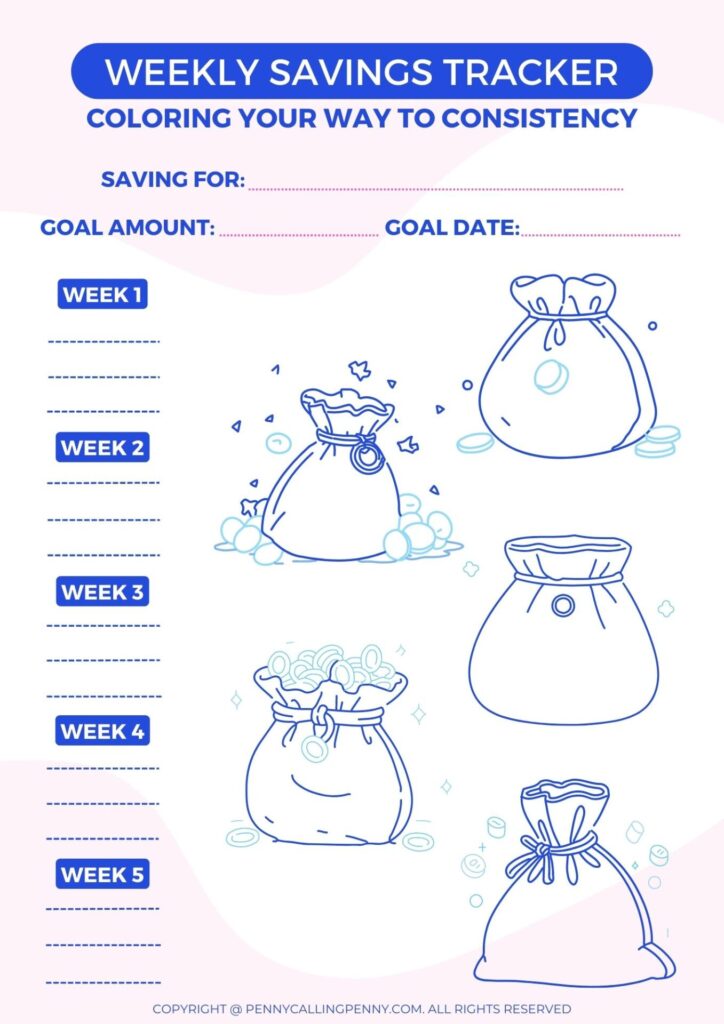

Weekly Savings Tracker: Coloring Your Way To Consistency

The weekly savings tracker is for those who want to build a consistent savings habit.

Consistency is key to achieving financial goals. This tracker turns saving into a rewarding and enjoyable routine.

How To Use:

Color in a section each time you save money. Use different colors for different weeks or goals.

This tracker will help you maintain a consistent savings habit throughout the year.

Wedding Wishes Garden: Blossoming Love and Financial Planning

The wedding wishes garden is a heartwarming coloring sheet that combines wedding planning with financial preparation.

Weddings can be costly, but this coloring sheet helps you keep your financial goals in mind while celebrating your love.

How To Use:

Each time you budget for a wedding expense, color in a flower on the garden template.

Use different colors for different aspects of the wedding.

The coloring sheet will help you keep track of wedding costs while celebrating your love and financial goals.

Conclusion

In conclusion, “Savings and Debt Payoff Coloring Pages” are more than just creative outlets; they are powerful tools for managing finances and achieving financial goals.

The combination of visual representation, positive reinforcement, and stress relief makes them an effective way to stay on track while enjoying the process.

So why wait? Start your financial journey with these engaging coloring pages today.

Find this helpful? Share it on Pinterest, LinkedIn and Facebook for your dear ones. Also, subscribe to our newsletter to receive articles like these straight to your inbox.

Did you take our Reader Survey? If not, it only takes 1 minute and you can take our survey here.

FAQs

No, these coloring pages are suitable for individuals of all ages, including children. They can be tailored to match age-appropriate financial goals.

Absolutely! Digital coloring apps can be a convenient and eco-friendly alternative to traditional paper pages.

While research specifically on financial coloring pages is limited, studies on the therapeutic benefits of coloring, visualization, and positive reinforcement all contribute to the potential effectiveness of these pages.

Yes, one of the best aspects of these coloring pages is their flexibility. You can design them to align precisely with your individual financial aspirations.

Yes, coloring pages act as a visual representation of your debt payoff journey, making it more manageable and motivating as you track your progress.