StellarFi

Trustpilot Rating – 4.3/5

StellarFi offers a user-friendly platform with simple eligibility criteria, positively impacting users’ credit scores through timely bill payments and transparent credit reporting to major credit bureaus such as Experian and Equifax.

Credit score improvement

Affordable pricing plans

Responsive customer support

User-friendly interface

Quick Facts About StellarFi

- Name: StellarFi

- Type: Credit Building App

- Purpose: Help users build credit using existing bill payments.

Introduction

With credit management becoming a growing concern among many Americans, recent studies reveal that over 60% of individuals are anxious about their credit scores and the subsequent impact on their financial prospects.

Additionally, nearly 40% find it challenging to meet their bill payment obligations, underscoring the critical need for a dependable solution.

This is where StellarFi comes into play, providing a user-friendly bill payment service that syncs effortlessly with your checking account, offering a pathway to better bill management and potentially enhancing your credit standing.

However, as with any financial service, there are nuances and user experiences that can significantly impact how effective and trustworthy it is perceived to be.

In this comprehensive analysis, we delve into the key features, benefits, and drawbacks of StellarFi, aiming to provide you with valuable insights to make informed financial decisions.

What Exactly Is StellarFi?

StellarFi emerges as a game-changer in the realm of credit building, offering a unique approach that distinguishes it from traditional methods.

Unlike conventional credit cards or loans, StellarFi empowers users to enhance their credit history through regular, unreported bills such as rent, utilities, and phone bills.

Who Benefits Most From StellarFi?

StellarFi caters to individuals seeking to improve their credit standing without relying on credit cards or loans.

This platform is especially beneficial for those looking to build a robust credit history by leveraging their household bills.

Is It Worth It? Should You Be Using/Buying It?

Absolutely. StellarFi offers a unique approach for individuals aiming to enhance their credit standing without taking on additional debt.

By automating bill payments and emphasizing timely payments, StellarFi contributes positively to users’ credit scores over time.

Its inclusive onboarding process ensures accessibility across various credit backgrounds, making it a viable option for a wide range of users.

While there may be associated fees with using StellarFi, the potential benefits in terms of credit improvement, streamlined bill management, and overall financial responsibility make it a worthwhile consideration.

Users can enjoy the convenience of automated payments while working towards better credit terms and financial stability.

StellarFi’s Features

1. Simplified Bill Payments

StellarFi simplifies bill payments by directly linking to users’ checking accounts.

This integration enables automatic payments, reducing the need for manual transactions and minimizing the risk of missing payment deadlines.

Users can set up recurring payments for various expenses such as rent, utilities, subscriptions, and more, ensuring bills are paid on time without the hassle of remembering due dates or logging into multiple accounts.

2. Credit Improvement Potential

One of the most significant benefits of StellarFi is its potential to positively impact users’ credit scores.

By ensuring timely bill payments, StellarFi contributes to a positive payment history, which is a crucial factor in credit scoring models.

This proactive approach to managing bills can lead to improved creditworthiness over time, opening doors to better credit terms, loan approvals, and financial opportunities.

3. Identity Verification

StellarFi takes an inclusive approach to onboarding by prioritizing identity verification over credit scores.

This means that individuals with diverse credit backgrounds can access the service, regardless of their credit history.

By focusing on identity verification, StellarFi aims to create a more accessible platform for users who may have faced challenges with traditional credit-based services.

StellarFi’s Functionality

1. Seamless Setup Process

The setup process for StellarFi is seamless and user-friendly. Upon approval, users gain access to the StellarFi virtual card and accompanying app.

Linking a checking account is straightforward, and users can customize their bill payment preferences within the app.

This streamlined setup ensures that users can start benefiting from StellarFi’s features quickly and efficiently.

2. Automated Bill Payments

StellarFi’s automated bill payment feature is a game-changer for users looking to simplify their financial management.

Once set up, StellarFi automatically processes bill payments based on scheduled due dates.

This automation reduces the burden of manual bill payments and helps users avoid late fees or missed payments, contributing to a more organized and stress-free financial experience.

3. Credit Reporting Mechanism

One of StellarFi’s standout features is its credit reporting mechanism to major bureaus like Experian and Equifax.

Through batch reports, StellarFi reflects users’ timely bill payments to these bureaus, helping users build a positive credit history.

This reporting mechanism is instrumental in improving credit scores over time and demonstrating responsible financial behavior to potential lenders.

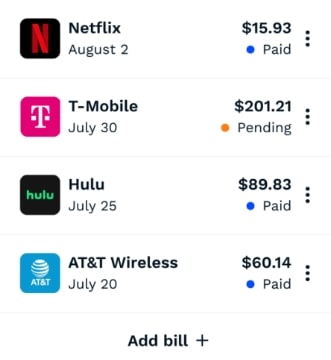

User Experiences And Concerns

1. Payment Timing And Account Linkage

StellarFi has implemented a proactive approach to address concerns regarding payment timing and account linkage.

By emphasizing the necessity of linked accounts for timely payments and positive credit history, StellarFi ensures that users can effectively manage their bills without the risk of overdrafts.

This proactive stance reflects StellarFi’s commitment to providing a seamless and reliable bill payment experience for its users.

2. Customer Support And Communication

StellarFi is dedicated to enhancing customer support services and communication channels.

Recognizing the importance of clear communication and efficient support, StellarFi is actively improving its processes to ensure that users receive prompt resolutions to their queries and concerns.

This focus on improving customer support reflects StellarFi’s dedication to prioritizing user satisfaction and building trust among its user base.

3. Service Enhancements And Technical Solutions

StellarFi is continuously working to address service limitations and technical issues to enhance user experience and service reliability.

By addressing challenges such as specific bill payment methods and accurate bank balance updates, StellarFi is committed to providing a comprehensive and effective bill payment platform.

These enhancements demonstrate StellarFi’s commitment to delivering a user-friendly and efficient service for its users.

4. Responsiveness To User Feedback

StellarFi’s responsiveness to user feedback is commendable. The company actively listens to user concerns and incorporates feedback into its development processes.

This approach ensures that StellarFi continuously improves navigation, clarifies payment processes, and enhances overall service functionality based on user input.

StellarFi’s willingness to adapt and evolve based on user feedback reflects its commitment to delivering a high-quality and user-centric service.

Plan Options And Cost Structure

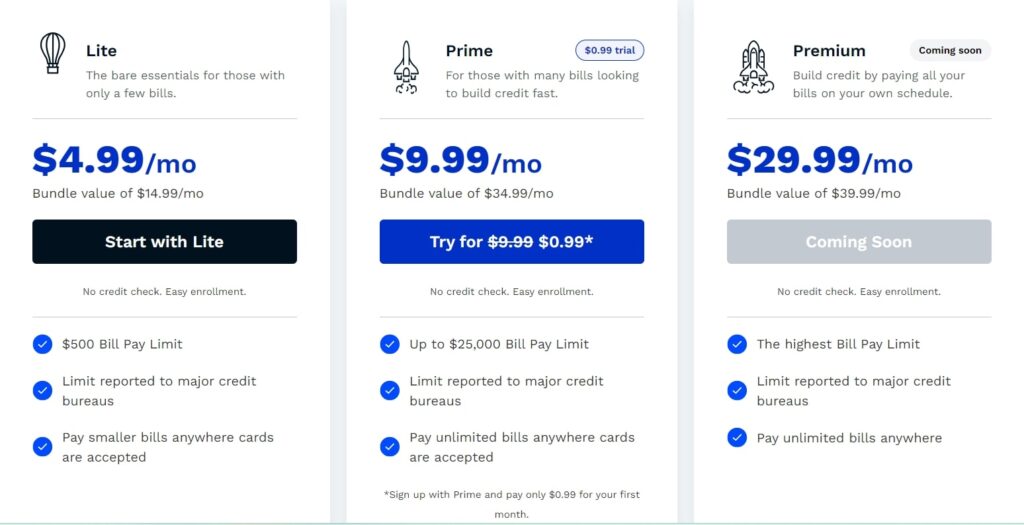

StellarFi offers two distinct plans, each tailored to meet varying user needs.

Let’s explore the features and costs associated with each plan:-

(1) Lite Plan

- Cost: $4.99 per month

- Key Features:

- Up to $500 monthly bills reported to credit bureaus.

- Credit education resources.

- Bill monitoring and status updates.

- Custom credit goals setting.

- Bill payment notifications and autopay options.

(2) Prime Plan

- Cost: $9.99 per month (with a $0.99 trial for the first 30 days)

- Additional Features (in addition to Lite Plan):

- Up to $25,000 monthly bills reported to credit bureaus.

- Personalized perks and exclusive offers.

- Bill pays rewards.

- 1-on-1 live credit coaching.

(3) Premium Plan (Upcoming)

- Anticipated Cost: $29.99 per month

- Enhanced Features (in addition to Prime Plan):

- Bill payments via ACH transfers.

- Flexible bill payment dates.

- Identity protection measures.

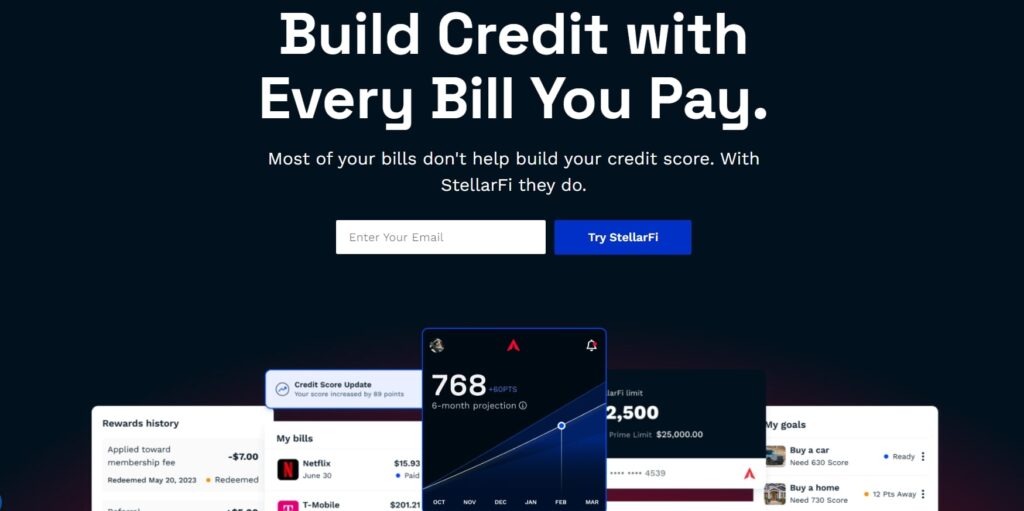

Build credit with every bill you pay.

How To Get Started With StellarFi?

Getting started with StellarFi is designed to be straightforward and user-friendly, ensuring a smooth onboarding process for users:-

1. Download The StellarFi App

Begin by downloading the StellarFi mobile application from your device’s app store.

The app is available for both iOS and Android platforms, making it accessible to a wide range of users.

2. Create An Account

Once you have downloaded the app, proceed to create your StellarFi account.

The registration process typically involves providing basic personal information such as your name, email address, and creating a secure password.

StellarFi prioritizes identity verification during this step to ensure security and authenticity.

3. Link Your Checking Account

After successfully creating your account, the next step is to link your bank account to the StellarFi app.

This linkage is essential for seamless bill payments and credit reporting.

StellarFi utilizes secure encryption protocols to safeguard your banking information, maintaining a high level of privacy and security.

4. Select Bills For Credit Building

Once your bank account is linked, you can proceed to select the bills you want to report for credit building purposes.

StellarFi offers a user-friendly interface where you can easily view and manage your bills.

Selecting bills for credit building ensures that your timely payments are reflected positively in your credit history, contributing to overall credit improvement.

By following these simple steps, you can get started with StellarFi and leverage its features to streamline bill payments, build credit responsibly, and improve your financial well-being.

StellarFi’s intuitive app design and emphasis on security make it a convenient and reliable choice for users seeking to manage their finances effectively.

What Sets It Apart?

StellarFi stands out in several key areas that differentiate it from other credit-building services:-

1. Affordability And Accessibility

StellarFi’s pricing structure is highly competitive, offering the Lite plan at just $4.99 per month.

This affordability makes credit building accessible to a broader audience, especially when compared to other services with higher monthly fees.

The lower cost enables more individuals to participate in credit-building activities without significant financial barriers.

2. No Credit Check Or APR

A notable feature of StellarFi is its elimination of credit checks and absence of APR charges.

Unlike traditional credit cards that often require credit checks and impose interest rates, StellarFi provides a transparent and straightforward credit-building solution.

This feature appeals to individuals who prefer to avoid credit inquiries and the complexities associated with APR calculations.

3. Credit Reporting To Major Bureaus

StellarFi’s reporting to major credit bureaus such as Experian and Equifax adds substantial value to users.

By contributing to a comprehensive credit profile, StellarFi helps users establish and improve their credit history.

While some competitors may focus solely on reporting to one bureau, StellarFi’s dual reporting sets it apart and provides users with a more holistic credit-building experience.

Areas For Improvement

1. Bill Types Limitation

One area where StellarFi can improve is in its support for bill types requiring bank account and routing numbers.

Presently, StellarFi does not support such bills. However, the forthcoming Premium plan aims to address this limitation by enabling bill payments via ACH transfers.

This enhancement will expand StellarFi’s utility and appeal to users with diverse bill payment needs.

2. Enhanced User Interface And Experience

There’s potential for StellarFi to further enhance its user interface (UI) and overall user experience (UX) within the app.

While the current UI/UX design is functional, minor improvements could make navigation more intuitive and streamline processes for users

Despite these areas for improvement, StellarFi’s competitive pricing, transparent approach, dual credit bureau reporting, and ongoing innovations position it as a compelling choice for individuals looking to build or improve their credit profiles.

Comparing StellarFi To Alternatives

In order to provide a comprehensive comparison, let’s briefly explore how StellarFi stacks up against other credit-building options:-

1. Fizz Debit CardThe Fizz Debit Card is an alternative credit-building option that shares similarities with StellarFi but differs in key aspects:-

(i) Credit Reporting: While both Fizz Debit Card and StellarFi offer credit building, Fizz may lack reporting to major credit bureaus like Experian and Equifax.

This limitation can impact the comprehensiveness of the credit profile established through Fizz compared to StellarFi’s dual bureau reporting.

(ii) Billing and Reporting: Fizz Debit Card may offer bill payments, but the reporting capabilities to major bureaus might not be as robust as StellarFi.

Users considering Fizz should carefully evaluate the extent to which their bill payments contribute to credit improvement compared to StellarFi’s comprehensive reporting mechanisms.

2. Step

Step is another credit-building option that focuses on providing users with tools to improve their credit scores. Here’s how it compares to StellarFi:-

(i) Credit Building Focus: Both Step and StellarFi prioritize credit building as a core feature.

However, the methods and extent to which they facilitate credit improvement may vary.

Users should assess whether Step’s approach aligns with their credit-building goals and needs compared to StellarFi’s offerings.

(ii) Bill Reporting Capabilities: While Step emphasizes credit building, it may not offer the same level of bill reporting capabilities as StellarFi.

Users seeking robust bill reporting to major credit bureaus should consider StellarFi’s dual reporting feature as a potential advantage over alternatives like Step.

While alternatives like Fizz Debit Card and Step also offer credit-building functionalities, StellarFi’s dual credit bureau reporting, comprehensive bill reporting capabilities, and competitive pricing position it as a strong contender for individuals looking to build or improve their credit profiles effectively.

Users should evaluate their specific credit goals, reporting needs, and budget considerations when comparing StellarFi to alternative options.

Eligibility Criteria

StellarFi has established a straightforward eligibility criterion to ensure accessibility for interested users:-

1. Residency and Age

Users must be residents of the United States, aged 18 years or above, to qualify for StellarFi services.

This criterion ensures compliance with regulatory requirements and aligns with the target demographic for credit-building services.

2. Documentation Requirements

As part of the account setup process, users are required to provide a valid Social Security number and have an active bank account.

This documentation helps verify users’ identities and enables seamless integration with StellarFi’s bill payment and credit reporting systems.

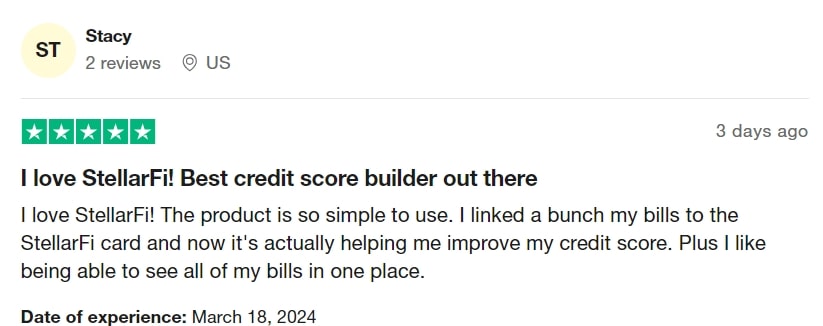

Customer Experience With StellarFi

StellarFi has received positive feedback from users, indicating a favorable customer experience across various aspects:-

1. Credit Score Impact

Users have reported a positive impact on their credit scores after using StellarFi’s services.

Timely bill payments and credit reporting to major bureaus contribute significantly to improving users’ creditworthiness and financial profiles.

2. Excellent Customer Experience

StellarFi has earned widespread acclaim for providing an exceptional customer experience.

Users praise the platform for its user-friendly interface, responsive customer support, and transparent communication.

StellarFi’s dedication to addressing user concerns promptly and offering personalized assistance contributes significantly to its reputation for excellence in customer service.

3. Gaining Points

StellarFi’s loyalty program rewards users for their engagement and responsible financial behavior.

Users can earn points for making on-time payments, utilizing educational resources, and actively managing their accounts.

These points can be redeemed for various benefits, such as discounts on fees, access to exclusive offers, and even cashback rewards.

The loyalty program enhances user satisfaction and incentivizes positive financial habits.

4. Ease Of Setup

Users appreciate the ease and simplicity of setting up a StellarFi account.

The intuitive interface and clear instructions streamline the onboarding process, allowing users to start benefiting from credit-building features promptly.

Is StellarFi Worth It?

In conclusion, StellarFi emerges as a compelling option for individuals seeking an alternative approach to credit building.

With its competitive pricing, dual bureau reporting, and user-friendly interface, StellarFi stands as a frontrunner in the credit-building landscape.

While mindful of its limitations, such as bill type restrictions and monthly costs, StellarFi’s potential to revolutionize credit building makes it a worthy contender in the financial services market.

Whether you’re a young professional establishing credit or someone rebuilding their financial standing, StellarFi’s innovative features, affordability, and user-centric approach make it a highly recommended tool for achieving long-term financial success.

FAQs

StellarFi primarily focuses on recurring bills such as rent, utilities, and subscriptions for credit reporting. While it covers significant expenses, some bill types may not be eligible for reporting.

StellarFi employs robust encryption protocols and adheres to strict privacy policies to safeguard user data. Additionally, the app undergoes regular security audits to maintain data integrity.

Yes, StellarFi can benefit users with poor credit history by providing them with a structured approach to credit improvement. However, individual results may vary based on financial habits and credit management.

Yes, StellarFi offers flexibility with subscription cancellations, allowing users to discontinue services at any time without long-term commitments.

Yes, StellarFi’s premium plan includes credit monitoring services that notify users of significant changes or activities on their credit report, enhancing security and awareness.