Credit Pros

Trustpilot Rating – 4.5/5

It is a firm which helps you to repair your credit report. It has an A+ ranking on Better Business Bureau and assists you to dispute wrong items in credit reports. It also is involved in deleting errors along with credit monitoring.

Affordable Pricing

Easy to Read Credit Reports

Free Consultations

100% 90 Day Money Back Guarantee

Do you think that inaccurate and negative information is affecting your credit score? A bad credit score can limit you from accessing loans at a great interest rate, and it can also make it quite a challenge to access certain services, find a house to rent, or even a job.

Luckily, you can still fix your credit score and enjoy the benefits that come with an excellent credit score. One way to repair your bad credit score is to dispute inaccurate items in your credit information. And that is where a service provider like The Credit Pros comes into play.

The Credit Pros has been a credit repair firm in business for over a decade. Credit repair professionals here can help you dispute incorrect and damaging items in your credit report.

Below is The Credit Pros review to help you understand if this is the right credit repair company for you. Let’s take a look at the benefits, cons, prices, and fees of using The Credit Pros to repair your credit report.

Is Credit Repair A Good Option?

Credit repair can be quite a hassle. Yet when users get good creditworthiness, they can enjoy the advantages of a good credit score. Credit repair can help you in many ways like;

- Boost your creditworthiness. You can secure a higher credit limit and get inexpensive interest rates with an excellent credit score.

Additionally, you can acquire a credit card and mortgage to buy a new property effortlessly.

- Help you access services. Repairing bad credit can help you improve your score; hence you can rent an apartment, get a new car, or a job without a hassle.

- Stop harassment from debt collectors. As you repair your credit, you will have to pay off your debts which means you will not have issues anymore with debt collection agencies.

So when should you consider credit repair services? If you think your credit report has incorrect items, you should contemplate a credit repair service. Also, you can consider a credit repair service if you can’t access credit card services or your interest rates increase. Although credit repair is something that you can tackle, you have better chances of disputing errors in your report when you involve a professional credit repair person.

How Does A Credit Repair Service Help?

A credit repair service from a reputable company like The Credit Pros can help you in many ways. For instance, the professionals can help you dispute incorrect credit report entries, negotiate debt repayment, review your credit report, and much more. Also, credit repair service providers can reach out to your debt collectors.

Furthermore, when you deal with The Credit Pros, you deal with credit law experts who will go beyond to ensure that you improve your credit score. The most crucial part is that credit repair service providers can provide you with an action plan to ensure that your credit report is good at all times. They also provide financial planning tools and resources to ensure that negative entries never appear on your credit report.

Is The Credit Pros Legit?

The Credit Pros is a registered credit repair company based in Newark, New Jersey. Also, The Credit Pros has been in business since 2009, and it has the Better Business Bureau accrediting.

Furthermore, the team here is FICO certified, and you can be sure that you are in the hands of the best credit repair professionals. The Credit Pros’ founders are licensed credit law experts and practitioners. What’s more? The Credit Pros is an INC 5000 company.

Sign Up to start repairing your credit today!

What Type Of Services Does The Credit Pros Offer?

The Credit Pros offer a ton of value if you need to fix your credit report. Apart from fixing your credit report and removing errors, The Credit Pros offer credit monitoring.

The Credit Pros offer credit repair and monitoring services in three tiers, and some of these services include;

- A personalized consultation with a FICO-certified professional.

- Goodwill and debt validation letters to your creditors.

- Cease and desist letters.

- Unlimited dispute letters.

- Round-the-clock client support through their portal.

How Much Do The Credit Pros Cost?

The Credit Pro’s services can cost a pretty penny but are worth the value you get. This credit repair firm offers four different credit report management packages. The costs vary depending on the service package you sign up for and your needs. The Credit Pros bills monthly for as long as you need the service, and you can also cancel any time.

Credit Monitoring

Credit monitoring is the lowest package that The Credit Pros offer, with an enrollment cost of $19 and a monthly fee of $19. This bundle can cover your complete credit report, TransUnion credit score and monitoring, payday, dark web, social network, social security trace, and change of address monitoring.

Additionally, you will access financial management tools to help you keep up with your credit score. Also, with this package, The Credit Pros can help you fix one incorrect item on your credit report.

Money Management

Money management is the second tier offered by The Credit Pros. This bundle is a little pricier than the Creditsentry Monitoring offer, but it covers all the items in the first package and a lot more. You will have to pay a $119 joining fee and an additional $69 per month for this service.

In addition to the first credit repair package services, you will get money management tools like bill reminders and a budgeting system.

Also, you will get resources like snowball and avalanche debt repayment strategies to help you settle all your debts. You will also get access to The Credit Pros legal network to help you resolve credit disputes. Another thing you can get on this package is the validation letter to creditors.

Prosperity Package

Prosperity package is the best offer for you if you need a turnkey credit report repair and money management solution. Ideally, this is the credit repair plan for you if you need to fix several incorrect and harmful items in your credit report. This package offered by The Credit Pros includes credit monitoring, credit repair service, and money management tools and resources.

Moreover, the enrollment fee for the prosperity package is $119 and an additional $119 per month to cater to your credit monitoring and other services.

Success Package

The final plan you can sign up for with The Credit Pros is the success package. This is the highest-level plan for consumers who need complete credit repair, money management, and credit monitoring services. It costs $149 to enroll in this package, and also you will pay a monthly fee of $149.

With the Success package, you will get a credit line in addition to all the services in the prosperity package.

Benefits Of The Credit Pros

The Credit Pros stand out from competitors because of the value they offer regardless of the credit repair plan you choose. One of the benefits of The Credit Pros is that they offer money management resources and tools to help you maintain a positive credit report. The Credit Pros also provide credit monitoring, unlike other credit repair companies. Another benefit is that The Credit Pros provide a free one-on-one consultation.

Also, they guarantee money back after 90 days. And that means that if you don’t see any benefit of their credit repair service after 90 days, they will refund your money in full. With The Credit Pros, you can cancel your plan subscription anytime without a hassle.

Another benefit of using The Credit Pros is that you can qualify for discounts, especially for couples. Military deals and fixed income discounts may also be available. Furthermore, your information is safe with The Credit Pros, and they don’t overpromise.

Disadvantages Of The Credit Pros

The flip side about The Credit Pros is that their packages can be pretty expensive compared to other providers. You pay an upfront fee and add a monthly fee, making it a bit pricey.

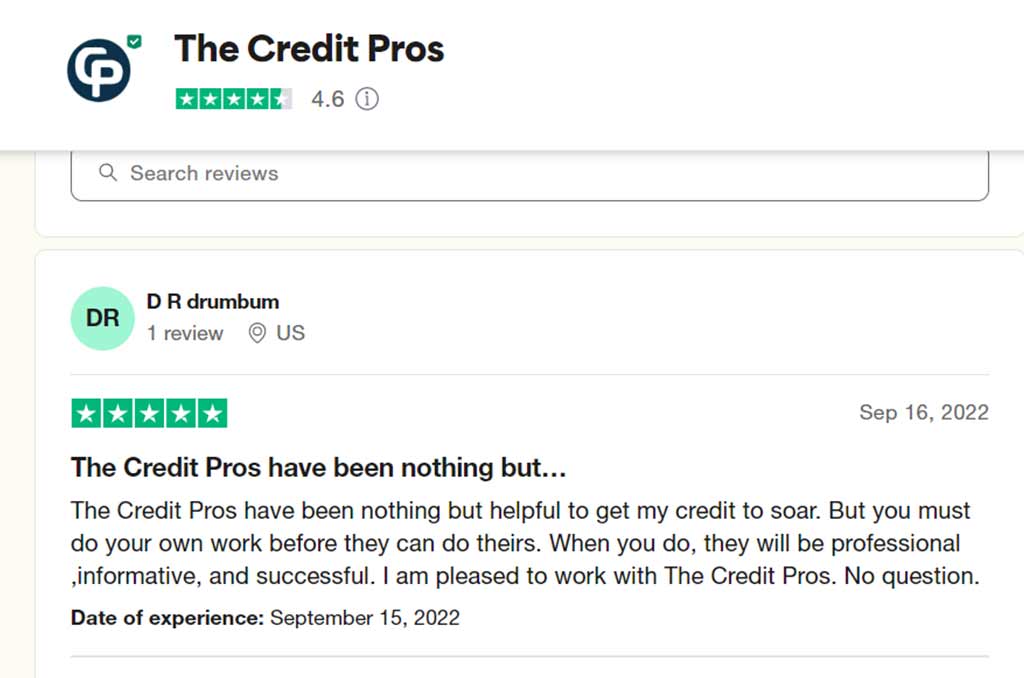

Customer Reviews On The Credit Pros

The Credit Pro has an impressive 4.8-star rating on Trust Pilot and a BBB rating of A- which means that this credit repair company does a pretty good job.

However, some customer reviews on The Credit Pros aren’t quite good. Some of the complaints are about problems when canceling their subscription.

Overall, we find that The Credit Pros offer a ton of value when looking to repair your credit. The Credit Pros also have an app you can download on AppStore and Google play store so you can get services right on your phone. There is also instant chat support on their website if you need to reach customer support.

To get started with The Credit Pros, you need to set up a free consultation with them through a phone call.

In all, a competent credit repair is imperative if you need to repair your credit report successfully and, ultimately, your credit score. The Credit Pros is worth it if you need a comprehensive credit report and monitoring service.

Hopefully, our Credit Pros review will help you understand their offers and services.