With the average cost of car insurance steadily rising, finding ways to save money has become a top priority for many drivers. In fact, studies show that a significant percentage of drivers feel the financial strain of insurance premiums each year, leading them to search for practical solutions to reduce their expenses. If you’re among those looking to cut costs without compromising on coverage, you’re in the right place. This blog will explore effective strategies and tips on how to save money on car insurance, helping you navigate the complexities of insurance policies while keeping more money in your pocket.

How Much Does Car Insurance Cost?

Car insurance costs can vary significantly based on multiple factors, making it crucial for drivers to understand these variables when budgeting for insurance expenses. In 2023, the average cost of car insurance for a typical driver was $1,176 per year, according to data from the National Association of Insurance Commissioners (NAIC). This figure represents a 2.4% decrease from the previous year, indicating a slight downward trend in premiums.

However, it’s important to note that these average costs can differ based on several factors. For instance, the state in which a driver lives plays a significant role in determining insurance rates. States with higher population densities or more traffic congestion tend to have higher insurance premiums due to increased risks of accidents and claims. Additionally, each state has its own insurance regulations and requirements, further impacting the cost of coverage.

The options available from insurance companies also contribute to the variability in costs. Different insurers may offer varying rates for similar coverage levels, depending on their risk assessment models, customer demographics, and overall business strategies. This makes it beneficial for drivers to shop around and compare quotes from multiple insurers to find the most competitive rates.

This is where Insurify comes into play. It offers a platform where drivers can input their specific details and preferences. Based on this information, Insurify generates personalized quotes from various insurance providers. This service empowers drivers to compare rates efficiently and make well-informed decisions about their insurance coverage. By leveraging Insurify’s capabilities, individuals can navigate through the complexities of insurance options and secure the most competitive rates that align with their needs and budget.

Furthermore, the type and level of coverage a driver carries can greatly influence their insurance costs. Basic liability coverage, which is typically required by law, tends to be more affordable compared to comprehensive or collision coverage, which provide broader protection but come at a higher cost. Factors such as the driver’s age, driving history, credit score, and the type of vehicle they drive also play roles in determining insurance premiums.

Taking all these factors into account, it’s essential for drivers to assess their individual insurance needs, compare quotes from different providers, and consider factors like deductibles and coverage limits to find the most cost-effective and suitable car insurance policy for their specific situation.

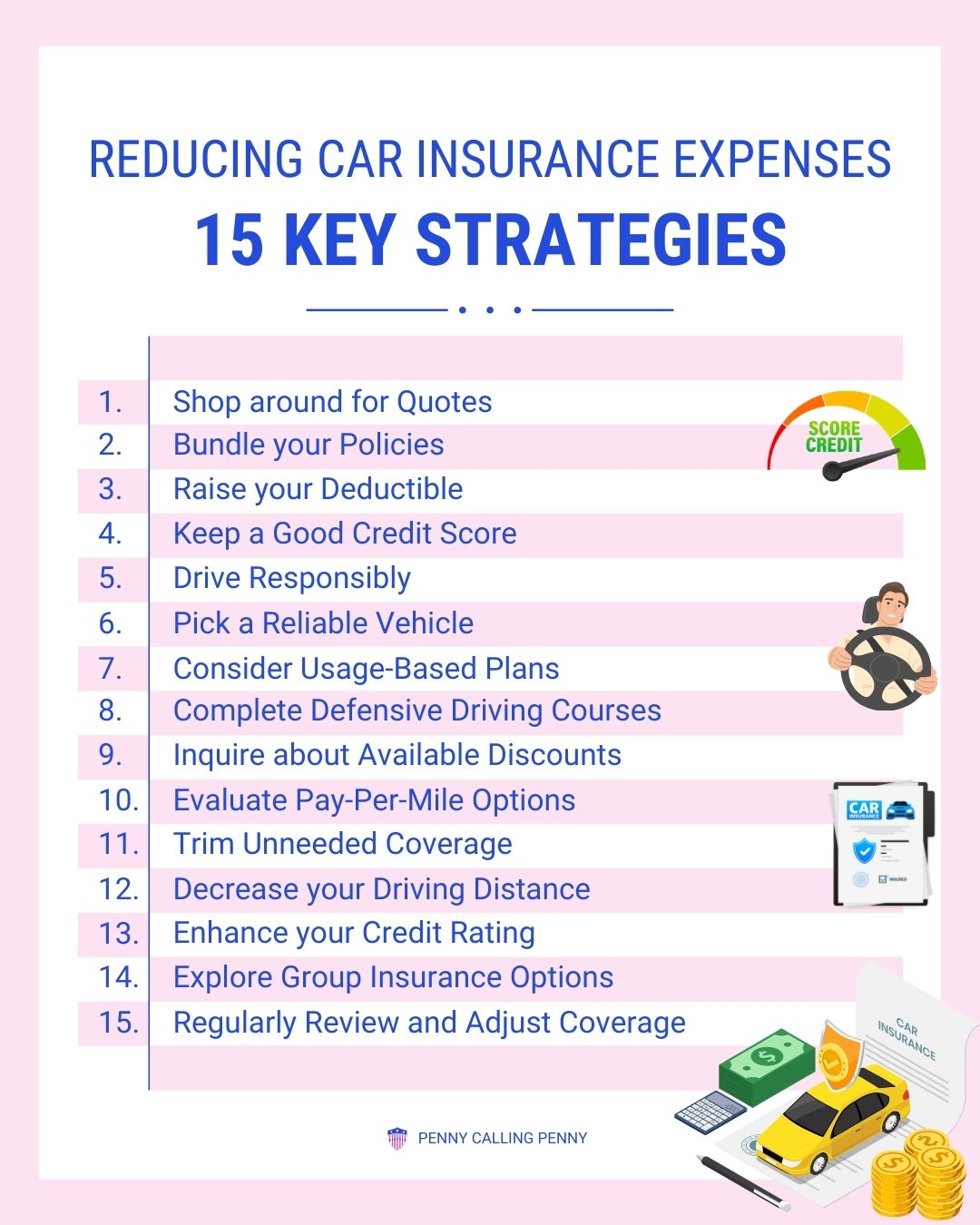

How To Save Money On Car Insurance?

1. Shop Around

When shopping for car insurance, it’s crucial to compare quotes from multiple insurers to get a comprehensive view of available options. Each insurance company has its own algorithms and factors that determine premiums, so rates can vary significantly. By obtaining quotes from at least three insurers, you can identify patterns in pricing and coverage offerings. Look beyond the price tag; consider factors like coverage limits, deductibles, customer service reputation, and available discounts when making comparisons. For instance, Company A might quote you $1,500 per year, while Company B offers the same coverage for $1,200. That’s a $300 savings just by shopping around.

For competitive rates and excellent service, include Lemonade in your comparisons. Their innovative approach often results in lower premiums and faster claims.

2. Bundle Policies

Bundling your insurance policies, such as combining auto, home, and possibly even life insurance, can lead to substantial savings. Insurance companies often incentivize bundling by offering discounts, sometimes ranging from 10% to 25%, on each policy included in the bundle. Beyond cost savings, bundling can streamline your insurance management by consolidating policies under one provider, making it easier to track coverage and payments.

3. Maintain Good Credit

Your credit score plays a significant role in determining your insurance premiums. Insurers use credit information to assess your financial responsibility and risk level. Those with higher credit scores often receive lower premiums, while lower scores may result in higher rates. In a survey it is found that drivers with excellent credit scores might pay $1,000 less per year compared to those with poor credit. To maintain good credit, focus on paying bills on time, keeping credit card balances low, monitoring your credit report for errors, and avoiding excessive new credit applications.

4. Drive Safely

Remember, slow and steady wins the race. Drivers with clean records and no accidents or tickets are rewarded with lower premiums. A single speeding ticket could increase your premium by 20% or more.

Safe driving habits not only reduce the risk of accidents but also lead to lower insurance costs. Insurance companies reward safe drivers with lower premiums, discounts for accident-free periods, and incentives for completing defensive driving courses. Avoiding speeding tickets, at-fault accidents, DUIs, and other traffic violations can help maintain a clean driving record and qualify you for lower insurance rates.

5. Choose A Higher Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your monthly premiums, as you’re taking on more financial responsibility in the event of a claim. For instance, increasing your deductible from $500 to $1,000 could save you 10% to 20% on your premium. However, it’s essential to assess your financial situation and ensure you have enough savings set aside to cover the deductible comfortably.

6. Drive Less

Cut down on mileage, cut down on costs. If you drive fewer miles annually, you may qualify for a low-mileage discount. Insurance companies often offer discounts to drivers who log fewer miles annually. Driving 10,000 miles per year instead of 15,000 could save you $100 or more. If you have a short commute, carpool with coworkers, or use public transportation regularly, you may qualify for a low-mileage discount. Providing accurate mileage information to your insurer and exploring usage-based insurance programs can help maximize potential savings based on your driving habits.

7. Take A Defensive Driving Course

Completing a defensive driving course not only enhances your driving skills and safety awareness but can also result in insurance discounts. These courses cover topics like defensive driving techniques, hazard recognition, and collision prevention strategies. It’s like adding an extra layer of armor. Completing a defensive driving course not only improves your skills but can also earn you a discount of up to 10% with many insurers

8. Maintain A Safe Vehicle

Keeping your vehicle well-maintained and equipped with safety features can lead to lower insurance premiums. Safety features such as airbags, anti-lock brakes, traction control, electronic stability control, and anti-theft devices reduce the risk of accidents and theft, making your car less expensive to insure. Insurers often offer discounts for vehicles with these safety features installed, so consider upgrading your vehicle’s safety features if possible.

9. Ask About Discounts

Don’t be shy to ask. Insurers offer various discounts. For example, a multi-car discount can save you 10% to 25% if you insure multiple vehicles with the same company. These discounts can vary widely and may include options such as multi-policy discounts, good student discounts, military discounts, senior discounts, loyalty rewards, and more. By actively seeking out and taking advantage of applicable discounts, you can reduce your overall insurance costs significantly.

10. Review Your Coverage

Don’t pay for what you don’t need. Regularly review your coverage to ensure it matches your current needs. Regularly review your insurance coverage to ensure it aligns with your current needs and circumstances. Factors such as changes in vehicle value, driving habits, and life events (such as marriage or moving) can impact your insurance needs. Adjusting your coverage limits, deductibles, and optional coverages accordingly can help you avoid overpaying for coverage you don’t need or gaps in coverage that could leave you financially vulnerable.

If your car is older and paid off, you may not need comprehensive or collision coverage.

11. Consider Usage-Based Insurance

Some insurers offer usage-based insurance programs that track your driving habits. If you’re a safe driver, you may be eligible for lower rates based on factors like mileage, speed, and braking patterns, potentially saving you money based on your actual driving habits rather than general risk assumptions.

12. Pay In Full

Paying your insurance premium in full upfront rather than in monthly installments can often result in a discount from your insurer. This discount may vary depending on the insurance company but typically ranges from 5% to 10%. Additionally, paying in full can help you avoid potential fees or interest charges associated with installment payments.

13. Stay Loyal

Loyalty to your insurance company can sometimes pay off in the form of discounts or benefits for long-term customers. Inquire with your insurer about loyalty programs, renewal discounts, or other incentives available to customers who remain with the same insurance provider for an extended period.

14. Choose A Suitable Vehicle

When purchasing a new vehicle, consider how insurance costs may vary based on factors such as the car’s make, model, age, safety features, and repair costs. Generally, vehicles with higher safety ratings, lower theft rates, and lower repair costs may result in lower insurance premiums. A sports car might be thrilling, but it can also come with higher insurance premiums compared to a sedan or SUV. Researching insurance costs before buying a car can help you make an informed decision that aligns with your budget.

15. Ask For A Review

Regularly communicate with your insurance provider and request a policy review to ensure you’re maximizing available discounts and savings opportunities. Life changes such as getting married, moving, adding a new driver to your policy, or reaching a milestone age (such as turning 25) can impact your insurance rates. Updating your insurer with accurate information and asking about potential discounts can help ensure you’re getting the best possible rates.

What Affects Your Car Insurance Rates?

Several factors can influence the cost of car insurance. Here are some key factors:-

1. Driving Record: Your driving history is like your car’s resume! If it’s spotless with no accidents or tickets, you’re likely to get a “hired” sticker on your insurance rates, meaning lower premiums. But if your record is more colorful than a rainbow, expect your insurance costs to be as wild as a rollercoaster ride.

2. Age: Ah, the age factor! It’s like being carded at a bar – younger drivers often get the “sorry, kid” treatment with higher insurance rates. But as drivers age and gain more experience, insurance companies may lower premiums, considering older drivers as safer and more cautious on the r

3. Location: Your zip code is the secret sauce of insurance pricing. Living in a bustling city may mean paying “city slicker” premiums, while suburban or rural dwellers often enjoy “backroads bliss” with lower rates. Conversely, rural or suburban areas with fewer accidents and lower traffic density may enjoy lower insurance costs.

4. Vehicle Type: Your car isn’t just a ride; it’s a statement piece! Flashy sports cars and vintage gems might turn heads on the road, but they can also make your insurance rates jump like a high-flying stunt. On the other hand, vehicles equipped with advanced safety features and boasting a strong safety record tend to qualify for lower insurance rates.

5. Driving Habits: Your driving habits, including mileage and frequency of use, impact insurance costs. Regular commuters who clock high mileage face higher premiums due to increased exposure to potential accidents. Conversely, occasional drivers or those with limited mileage often receive lower insurance rates.

6. Credit Score: Your credit score isn’t just about financial street cred; it’s a VIP pass to lower insurance rates. Insurance companies consider your credit score as an indicator of financial responsibility and risk management. A higher credit score reflects responsible financial behavior, leading to lower insurance premiums. Conversely, a lower credit score may result in higher insurance costs due to perceived higher risk.

7. Coverage Levels: Choosing your insurance coverage is like building a burger – do you go all-in with extra toppings (comprehensive coverage) or stick to the basics (liability only)? Just remember, more coverage means a fuller belly but also a bigger bill. Choosing the right insurance coverage involves balancing protection and cost. Comprehensive coverage with higher limits and additional features comes at a higher cost compared to basic liability coverage. Opting for more extensive coverage increases protection but also leads to higher premiums.

8. Deductibles: The deductible amount you choose affects insurance premiums. A higher deductible means you agree to pay more out of pocket in the event of a claim, resulting in lower premiums. Conversely, a lower deductible leads to higher premiums but reduces your upfront costs in case of a claim.

9. Claims History: Insurance companies keep track of your claims history like a detective on a case. Stay “claim-free cool” for lower rates, but a pattern of frequent claims or a history of high-value claims may result in increased insurance costs

10. Marital Status: Tying the knot isn’t just about love – it’s a ticket to lower insurance rates! Married folks often enjoy the “happily-ever-after discount,” due to statistical data suggesting that married couples tend to exhibit safer driving behavior and are less likely to engage in risky activities on the road.

11. Gender: While gender-based pricing practices are becoming less common, historical data has shown that male drivers, on average, were associated with higher risk and therefore higher premiums. However, modern insurance practices aim to assess risk based on individual factors rather than generalizations based on gender.

12. Discounts: Who doesn’t love a good deal? Insurance companies offer discounts from bundling policies (the “two-for-one special”) to safe driver rewards (“golden ticket to savings”) and even perks for good grades or defensive driving courses (“smarty-pants discount”). So, hunt for those discounts like a treasure hunter seeking gold!

How Much Coverage Do You Need?

Determining the appropriate amount of insurance coverage necessitates a thorough analysis of various factors. Firstly, you should understand the legal requirements applicable in your region. These requirements typically mandate a minimum level of coverage, especially in terms of liability insurance, which protects you from financial losses in case you cause damage or injuries to others in an accident.

Secondly, consider the overall value of your assets. This encompasses not only tangible assets like your home and vehicles but also your savings, investments, and other financial holdings. The purpose of insurance is to shield these assets from potential risks and liabilities, so your coverage should be sufficient to safeguard them adequately.

Your income and financial stability also play a crucial role in determining the coverage you need. A higher income and greater financial stability may allow you to afford higher coverage limits, providing you with more extensive protection against potential risks and liabilities.

Assessing your risk exposure is another critical aspect. Factors such as your driving habits, the type of vehicle you own, your daily commute, and your lifestyle all contribute to your overall risk profile. Higher-risk activities or environments may necessitate additional coverage to mitigate potential financial losses.

It’s also essential to consider how your health insurance coverage interacts with your other insurance policies, such as auto or home insurance. Ensuring there are no gaps in coverage is vital to avoid unexpected financial burdens in case of accidents or emergencies.

For comprehensive protection, you might explore umbrella insurance policies. These policies offer additional liability coverage beyond the limits of your primary insurance policies, providing an extra layer of security against major liabilities and lawsuits.

Reviewing the policy limits and deductibles offered by insurance providers is crucial. Opt for coverage limits that adequately protect your assets and consider adjusting deductibles based on your ability to cover out-of-pocket expenses in case of a claim.

Seeking guidance from an insurance professional or financial advisor can be immensely beneficial if you’re uncertain about the appropriate coverage levels. They can assess your individual needs, risk factors, and financial goals to recommend suitable coverage options tailored to your specific situation.

Conclusion

In wrapping up, let’s put the “fun” back in funds with these quirky yet effective ways to save on car insurance! By implementing these money-saving tips, you’re not just cutting costs, you’re revving up your financial engine for a smoother ride ahead. Now, it’s your turn to take the wheel! Start implementing these tips today and watch your savings soar. Happy driving and even happier saving!

FAQs

Compare quotes widely, leverage discounts smartly, and opt for higher deductibles cautiously to trim costs effectively.

Geico, Progressive, and State Farm are renowned for offering competitive rates and reliable coverage, making them popular choices for budget-conscious drivers.

While it might be challenging, specialized insurers cater to high-risk drivers, and improving your driving record can gradually lower premiums over time.

Meet the minimum requirements set by your state, and assess your car’s value and personal finances to determine if additional coverage like collision or comprehensive is necessary.