What is the 50-20-30 budget rule? And how it can help you manage your finances? This rule was popularized by Senator Elizabeth Warren, in the book “All Your Worth: The Ultimate Lifetime Money Plan” as a way to help manage your budget.

Having no way to account for income and spending is stressful. Having little to no savings or investments just compounds that stress.

Today, we’ll look at the 50/20/30 budget rule in depth.

How Does the 50-20-30 Budget Rule Work? Is it Weekly or Monthly

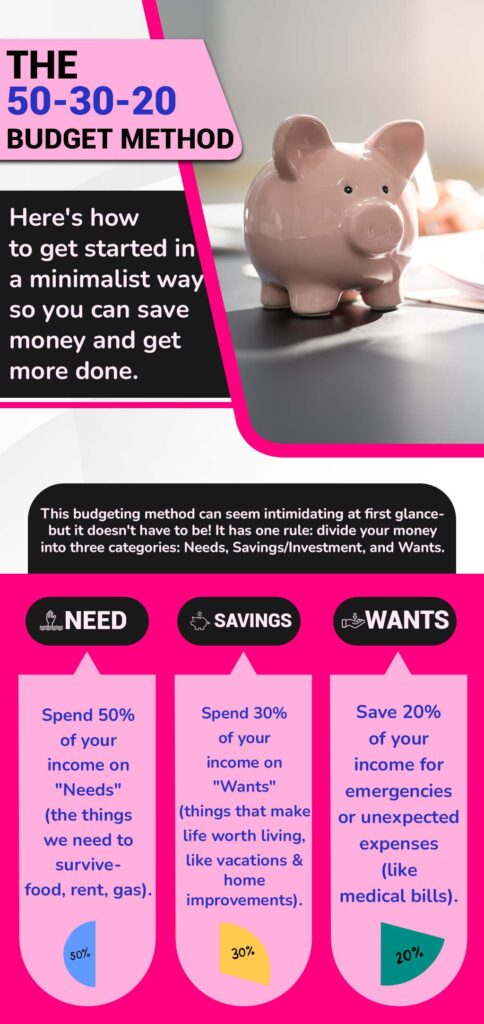

In a nutshell: the 50-20-30 budget rule is a money management strategy to help you split your after-tax income into three categories: Absolute needs, wants, and savings.

This budget rule can be pretty helpful, especially difficulty with balancing your bills, savings, and spending money on yourself. Typically, people use this as part of a monthly budget, since many bills are due monthly.

Now, onto what the three categories are and how the 50-20-30 rule works.

50% of Your Net Income Goes to Your Absolute Essentials

Once your paycheck hits your bank account, 50% pays for your absolute needs. Think of basic life needs like groceries, housing, healthcare, insurance, transport, and utilities.

Items that fall in the needs category can vary, but the idea here is that this category is for things that you can’t get through a day without… literally. This budgeting rule is flexible, so you get to decide what deserves a place here and what doesn’t.

What happens your necessities are more than 50% of your income?

First, don’t panic. You’re not alone, and you have a few options here. Some people pivot to the 70-20-10 rule instead, since this focuses a larger amount on needs.

You can also check everything on your “needs” list. Does it all belong there? Are there any ways that you can reduce some costs on this list? Alternatively, you can work on creating a perfect side hustle that brings in money to help you achieve your money goals.

20% of Your Net Income Goes to Your Savings, Investments, and Debt

Next, put 20% of your net income towards savings, investments, and settling debts.

You can contribute to your 401(k) account, Roth IRA, brokerage account, emergency fund, etc. Once you have an emergency fund, start to pay off debt, whether that’s a student loan, credit card debt, or medical debt.

Even if your 401(K) savings are automatically deductible through your employer, you can count that here.

Sticking to a saving plan can be a struggle, and this frame is a great measuring stick to help you achieve your goals.

30% of Your Net Income Goes to Your Wants

This is the last category in the 50-20-30 budget rule, and it’s all for you! Needs and wants can have a gray area between them, but there’s an easy way to split them.

What will the negative consequences be if I don’t buy this?

If the consequence is disappointment, frustration, embarrassment, or another emotional or social consequence, you can class this as a “want”.

On the other hand, if the consequence involves late fees, hurts your credit score, harms your health, or has some other financial or safety consequence, it’s safe to say that this is a “need”.

Remember, what works for someone else using this 50-20-30 budget rule may not necessarily work for you. (And vice versa.)

How To Use The 50-20-30 Budget Rule?

Putting the 50-20-30 budget rule in your budget is very straightforward.

First, take a look about how much money you make. If you’re an hourly worker or make tips, base this amount on the minimum you reliably make each month.

If your retirement contributions are automatically withdrawn, make sure you add them back in to the total.

Understanding your monthly net income is crucial because it gives you a solid idea of how much money you have to work with.

Once you have the actual income figure, you can start dividing it between each category. If you don’t know what your needs are, this is a great place to make a list.

Not a “pen and paper” person? No problem.

There are several budgeting apps that can streamline the process for you, whether you’re an iPhone or Android user.

Our recommendation? That has to be Goodbudget. This budgeting app uses the “envelope” budgeting system. When using the 50-20-30 budgeting rule, you can simply create three envelopes: “Needs”, “Saving/Invest”, and “Wants”.

With practice, you can make your categories more nuanced. You might add envelopes, remove expenses, or some combination. The important thing here is to track and set goals for your money.

Are you Spending in a Smart way?

If not, Get in control of your money! Our 50-30-20 Budgeting Printable helps you manage expenses and save for what matters.

- Keep track of your money coming in and going out.

- Prioritize needs, wants, and savings

- Set clear objectives and achieve them with purpose.

- Stay motivated with visible progress.

(By subscribing, you agree to our terms & conditions, privacy policy, and disclaimer.)

How Does The 50-20-30 Budget Rule Help Save Money?

The 50-20-30 budget concept helps you be smart with your money by giving you general, easy-to-follow guidelines. Budgeting is very personal, and you might not click with this rule.

The important thing is to give it a try. After all, you have to start somewhere! If you have debt that you’re trying to pay off, you might be worried that 20% isn’t enough to handle both debt and savings.

There are three solutions to this problem. You can either focus on paying off debt first and let saving take a backseat, you can class some of your debt pay-off as a “need”, or you can move 10%-15% from “wants” into “savings”.

The route you take is up to you. The important thing is that the 50-20-30 rule has savings built in, something that “winging it” just can’t provide.

Pros and Cons of 50-20-30 Budget Rule

Like any other money management principle out there, the 50-20-30 budget rule has its benefits and downsides.

One reason the 50-20-30 budget rule works is its simplicity. You only need to think about three “baskets” —needs, wants, and savings/debt/investment.

This rule helps you track your expenses and keep up with your monthly budget. No more stressing about missed bills! On top of all that, you get some money to spend on things you love.

Now onto the cons. This budget rule tends to come from a pretty privileged place. Not everyone makes enough money to have “only” half their income go to wants.

Besides just that, 20% is a tiny amount to squeeze investment, savings, AND debt payoff into. If you have several kinds of debt or a large minimum payment, that 20% might cover ONLY debt. That means your savings and investment are ignored (a huge problem).

Conclusion

The 50-20-30 budget rule can be an excellent financial blueprint to help you manage your money. Like all budgeting, though, it won’t necessarily fit your specific situation.

The most important thing the 50-20-30 rule can do for you is give you a simple place to start. The first step is the hardest, but it’s also the most important!

For more help with budgeting, including explanations for different methods, subscribe to Penny Calling Penny’s newsletter!