Key Takeaways

- Best bank for checking account with No Fees – Axos Bank

- Best bank for checking account with Mobile Check Deposits – Citibank

- Best bank for checking account for Cash Back Rewards – Discover Bank

- Best bank for checking account for ATM Reimbursement – EverBank

Choosing the best bank for a checking account can be a task if you are unfamiliar with each bank’s different services and terms and conditions.

Therefore, it is essential to learn about banks correctly, which is to compare them instead of opening an account in a bank nearest to your place.

Or else your money wouldn’t be close to you. We have curated a list of the 13 best banks for checking accounts in 2024 that might help you make the correct choice.

What Is A Checking Account?

It differs from a savings account, as it is used for every day and daily expenses.

A checking account is made to store your money in a bank account, a credit union, or any other kind of financial institution.

How Do These Work?

Electronically, crediting and debiting within the checking account happen automatically, usually overnight.

A paper check takes a few days to clear and is shown late in the report.

Meanwhile, debit card and ATM transactions will be conducted immediately.

Requirements For Opening Checking Account

Banks for checking accounts require several documents and other criteria to be fulfilled before they open an account in their bank.

Here is the list of the necessities for opening a checking account:-

1. Age: 18 years is a must for opening a checking account. But if you are in your teens and still want an account, you could opt for a teen, joint, or custodial account.

2. Address: Proof of speech is one of the most essential requirements for opening a checking account. You can give lease agreements, insurance cards, or even utility bills as proof of address.

3. Minimum Deposit: This depends on the bank you are opting for. It can be as low as $0 or even as high as $100.

4. Identification: Two identification proofs are required to open a checking account. These IDs could be driver’s licenses, passports, social security cards, or state IDs.

Features Of A Checking Account

Consider the following features when choosing the best bank for a checking account.

1. Fees: This is the cost of managing your money within the checking account. You must know about the bank’s monthly fee to maintain the performance.

2. Minimum Balance: This is the least amount you must maintain in your account or while opening. You can even compare different banks based on their minimum balance requirement.

3. Rewards: These are the benefits that come with your bank account. There are schemes like rewards for regular direct deposits or sometimes for maintaining a high balance.

4. Interest Rates: These are the amounts that the bank offers you to keep your money in the account. These differ per the bank; compare them before opening a checking account.

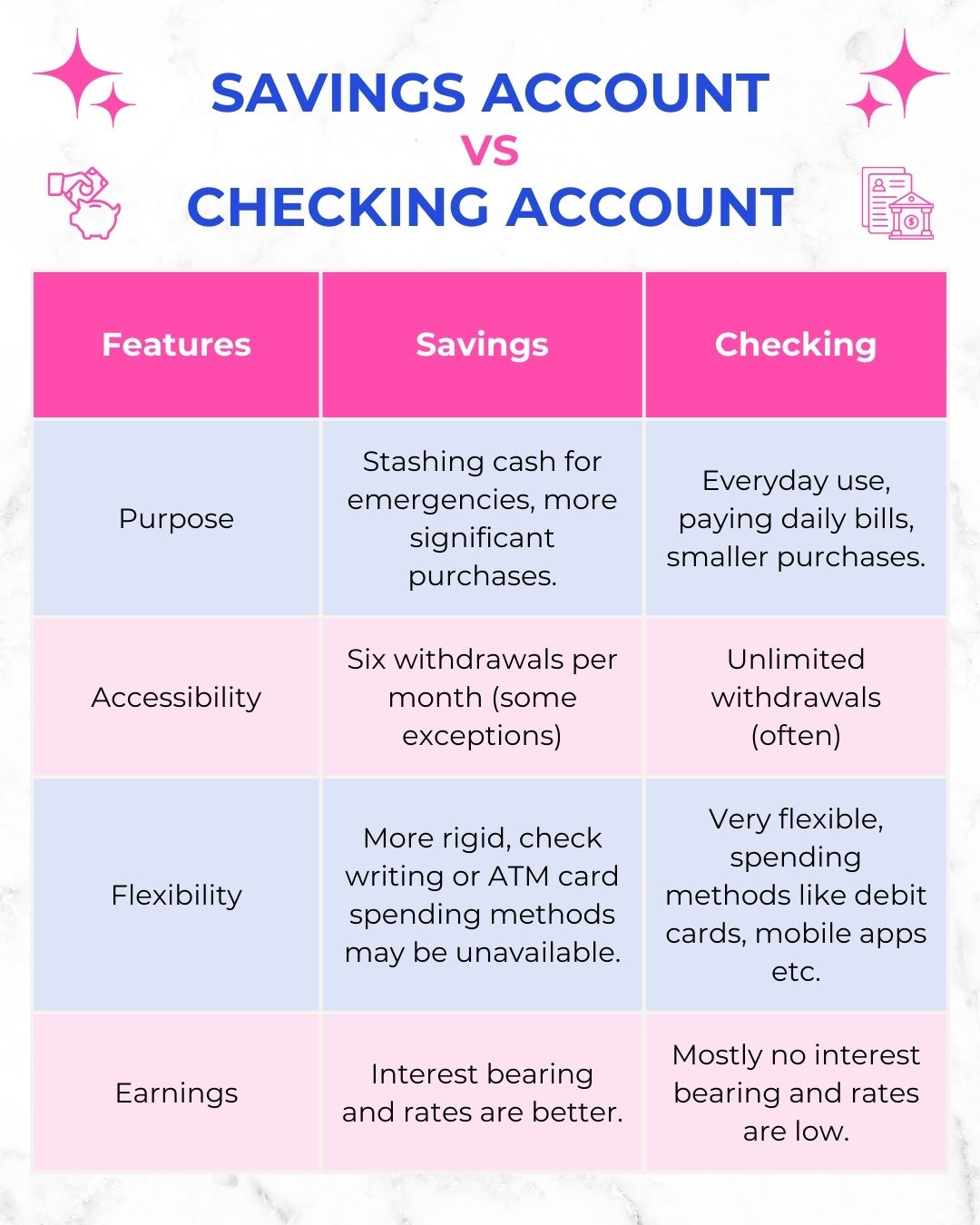

Savings v/s Checking Account

There is widespread confusion about not only the best banks for checking accounts but also if a savings account is better than a checking account.

Here is a guide to help you make a choice that is profitable to you.

How Do You Choose A Bank For A Checking Account?

It can be a difficult choice when looking at different banks for checking accounts.

This is because nearly all banks offer the same features.

But you must consciously choose and select the appropriate version for your money.

- A large amount of money: An account in an international bank with no monthly fee would be appropriate.

- NO Deposit Account: If you wish to have a checking account but no amount to deposit, you could look for online banks. Online banks offer the services of traditional banks but don’t require a minimum balance.

- Use of ATMs: If you wish to have a checking account in a bank that provides overseas ATM service, you could choose a bank that offers local discounts.

- Services: The bank you choose for checking must ultimately provide the best services at the lowest cost possible.

13 Best Banks For Checking Accounts In 2024

1. Ally Bank Spending Account

Minimum Deposit Requirement: $0

Monthly Maintenance Fee: $0

Ally Bank gives customers an interest rate of around 0.10% APY or 0.25% APY.

The interest rate depends on the account balance in your checking account.

Pros:

- 43000 fee-free ATMs.

- Receive $10 in ATM fee reimbursements for out-of-network ATMs/ statement cycles.

Cons:

Cash can’t be deposited in the Ally checking account.

2. Axos Bank Rewards Checking

Minimum Deposit Requirement: $50

Monthly Maintenance Fee: $0

Axos Bank gives customers an interest rate of around 3.30% APY.

It is easy to open an account with them.

Plus, maintaining it also doesn’t take a lot of effort.

Pros:

- No fee for non-sufficient funds or overdrafts.

- Interest Rate Structure’s competitive tiered nature.

Cons:

- Zero Physical Branches of the bank.

- No extra interest earnings over $50,000.

3. Discover Cashback Debit Checking

Minimum Deposit Requirement: $0

Monthly Maintenance Fee: $0

This bank gives customers 1% cash back on up to $3000 in monthly debit card purchases.

Pros:

- No sufficient funds or ATM fees.

- Cashback rewards for debit card purchases.

Cons:

- Zero interest earned.

- A threshold on cashback qualifying is $3000/ month.

4. PenFed Credit Union Access America Checking

Minimum Deposit Requirement: $25

Monthly Maintenance Fee: $10

This bank gives a tiered dividend rate, which is easy to meet.

It offers 0.15% APY on $500 or more recurring direct deposit and maintains a daily balance of $19,999.99.

The APY could increase to 0.35% as daily balances rise between $20,000 to $50,000.

Pros:

- High-rated mobile app

- Large ATM network

Cons:

- $30 non-sufficient funds fee.

- Repeating direct deposit necessary to earn interest.

5. NBKC Bank Everything Account

Minimum Deposit Requirement: $0

Monthly Maintenance Fee: $0

NBKC Bank gives facilities for both checking and savings accounts in one account.

It offers 1.75% APY with no qualifications or minimum balance required.

Pros:

- Access to 37,000 MoneyPass ATMs.

- Reimbursement of $12/month for out-of-network ATM fees.

Cons:

- $45/transaction is the cost of international wire transfers.

- The low yield on checking accounts.

6. EverBank Yield Pledge Checking

Minimum Deposit Requirement: $100

Monthly Maintenance Fee: $0

EverBank gives some protection perks to the account.

It offers extended warranty protection, return protection, web safety guarantee protection, and price protection.

Pros:

- Reimbursement of $15/all account holders for out-of-network ATM fees.

- Earn APY of 0.45%.

Cons:

- Maintain a minimum daily balance of $5000 to reimburse unlimited out-of-network ATM fees.

- Outgoing international and domestic wire transfers cost around $25 to $65.

7. Citibank Access Account Package

Minimum Deposit Requirement: $0

Monthly Maintenance Fee: N/A

Citibank gives 24/7 access to the account online or through a mobile app.

This bank is different in the sense of its affordability and simplicity.

Pros:

- Zero overdraft fees.

- 65,000 surcharge-free ATMs.

Cons:

- Paper Checks unavailable.

- Zero Interest Paid.

- Zero out-of-network ATM fee reimbursement.

8. Quontic Bank High-Interest Checking

Minimum Deposit Requirement: $100

Monthly Maintenance Fee: $0

Quontic Bank gives up to 1.10% APY if you meet the monthly qualifying transaction requirement.

The bank does not require a minimum balance to get this rate.

Pros:

- 90.000 plus surcharge accessible ATMs.

- Low-interest rate if the monthly qualifying transaction requirement is not fulfilled.

Cons:

- Zero out-of-network ATM fee reimbursement.

9. Alliant Credit Union High Rate Checking

Minimum Deposit Requirement: $0

Monthly Maintenance Fee: $0

This bank gives digital banking tools.

You can manage money, use budgeting tools, and make payments through their website or app.

Pros:

- Contactless Visa Debit Card and Checks.

- $20 out-of-network ATM fee reimbursement.

Cons:

- Membership is a necessity.

- Zero physical credit union location.

10. Varo Bank Account

Minimum Deposit Requirement: $0

Monthly Maintenance Fee: $0

Varo Bank gives the facility of no transfer and foreign transaction fees.

It allows you to get payment up to two days prior with direct deposit, depending on when the employer makes the payment.

Pros:

- 90,000 plus retail locations for depositing cash.

- Contactless Visa Debit card gives money back.

Cons:

- Zero Interest Paid.

- $3 fee for out-of-network ATM transactions.

11. Connexus Credit Union Xtraordinary Checking

Minimum Deposit Requirement: $0

Monthly Maintenance Fee: $0

This bank offers 1.75% APY on the balance of $25,000 or less, and 0.25% amounts to more than $25,000, along with meeting the account’s monthly requirement.

You can pay bills online and deposit through mobile and peer-to-peer payments.

Pros:

- Monthly reimbursements for ATM provider surcharges.

- The high-interest rate comes with easy requirements.

Cons:

- Interests are summed and reimbursed monthly.

- A savings account is a must for getting a checking account.

12. Upgrade Rewards Checking Account

Minimum Deposit Requirement: $0

Monthly Maintenance Fee: $0

This bank offers 5.07% APY when you add a performance savings account. a

With an Upgrade Premier Savings Account and Upgrade Rewards Checking Plus, you can get competitive APY with an active account.

Pros:

- There are no ATM fees for active accounts. Reimbursement for five out-of-network ATM transactions.

- Two days early pay if you have direct deposit for your Account.

Cons:

- An active account with a monthly direct deposit of $1000 is necessary for additional rewards benefits.

- Zero physical branches.

13. CIT Bank E-Checking Account

Minimum Deposit Requirement: $100

Monthly Maintenance Fee: $0

CIT Bank offers 0.10 APY on account balances of $25000 or less and 0.25% APY on account balances of $25000 or more.

You will be charged nothing for overdraft fees or incoming wire transfers.

Pros:

- No ATM fees and reimbursement up to $30/month for out-of-network ATMs.

- You get interest on all balances.

Cons:

- No physical branch of the bank.

- Zero paper checks with the Account.

Other Banks For Checking Accounts

Here are some other banks for checking accounts that offer different fees and APY.

Bank For Checking Account | APY (in %) | Fees |

1.20 | None | |

None | None | |

None | Yes (waiverable) | |

2.09 | Overdraft Fees |

Conclusion

It is a rigorous task to choose the best bank for checking accounts.

It is essential to make the right choice since a checking account is an account you use for your regular transactions.

You must look for a bank that pays good APY and has zero or minimum fees for opening a checking account or account maintenance.

Look for features like free international transactions or a vast ATM network locally and globally.

Your money is your responsibility; do not hesitate to educate yourself on financial needs.

Explore our comprehensive guide on the best banks for checking accounts and make an informed and secure choice.

FAQs

You need to be 18 years or older to open a checking account. Further, you must provide proof of your address and identification. There is a difference in the minimum amount required to open a checking account. Look for the minimum or zero amount needed.

Most banks for checking accounts are FDIC insured, thus making your money safe. Usually, this insurance covers the amount that you have deposited in your checking account, along with interest owed up to $25,000.

There is no limit to the number of checking accounts you can open. However, applying for multiple accounts might cause a problem when opening other accounts. You must also know that with numerous reports, there is a limit on the amount you can store in each performance.

If you still haven’t found the best bank for checking accounts, you can look for alternatives like a savings account, prepaid debit card, or money market account.