With Christmas on the horizon, you’ve likely been preparing to find that perfect gift for your family and friends. But, you can’t seem to find the perfect Christmas gift to purchase. Chances are your “giftee” has everything, and you are wondering, is giving money a good Christmas gift? Yes! Gifting money can be an excellent idea for a Christmas gift. There are different ways you can give money as a gift to your loved one.

Gifting money may seem unconventional, but it can be one of the most meaningful presents you give. It allows your loved ones the freedom to choose how they want to use the funds—whether for paying off debts, investing in their dreams, or treating themselves to something special. Remember, as financial expert Suze Orman wisely puts it, “You can’t get in trouble if you don’t spend money.” So, what could be better than gifting someone the opportunity to invest in themselves?

In this article, you will find ways you can give money to your loved ones as gifts. But first off, let’s understand what financial gifts are and how you can give monetary gifts this Christmas.

What Are Financial Gifts?

Financial gifts are non-traditional presents that you give in assets, cash, or any other investment. Unlike other gifts, financial gifts can make a lasting impact on your giftee’s life. For instance, instead of giving your loved one a PlayStation as a gift, you can consider buying stocks.

Also, financial gifts can secure one’s future. For example, if you contribute to your loved one’s college savings account, it will help them pursue their studies without financial hassle.

Are Financial Gifts Taxable?

The most crucial thing to consider about gifting money is the tax. Luckily, you may not have to pay any tax on gifts unless you are super generous. And in this case, it means you plan to give over $11.7 million to your giftee.

According to the Internal Revenue Service (IRS), you can give up to $15,000 to one recipient per year without filing gift tax returns. If you feel more generous and want to give more than $15,000 per year as gifts to your loved one, you will need to fill form 709 to declare your financial gift. Moreover, a married couple can give a maximum of $30000 per year as gifts and won’t need to fill the paperwork.

Best Financial Gifts To Give This Christmas

Giving money is an excellent Christmas day gift for your loved one. Financial gifts are unique, and there are different ways to gift money.

For instance, instead of giving a present that lasts a few months, you can consider financial gifts that keep on giving. Below, find the best financial gifts for you to give this season.

What Are The Best Financial Gifts For A Child To Give This Christmas?

One of the best things you can do for a child is to help them learn more about money and understand wealth creation and management. The knowledge and experience about finances will enable them to be responsible and understand how to manage money for their good.

It’s always a precious feeling to have a smile on your child’s face. Hence, these financial gifts are a perfect fit for this Christmas.

Stocks

Investing in stocks can provide a great opportunity for long-term growth. Introducing your loved ones to the world of stocks as a financial gift for Christmas may spark their interest in investing.

Another benefit of gifting stocks is that it can help teach young people how and why they should invest and grow their wealth.

Also, you don’t need a lot of cash to buy stocks which means you can gift stocks of any amount. You can buy and transfer stocks as gifts to your children, grandchildren, relatives, and friends. Since kids can’t legally own an account until they are of age, you can open a custodial account for your kids.

A custodial account is an account you can open for a child and manage the account until the child turns 18 years. Anything you do with the account should be in the best interests of the child. You will then transfer the account to your child once they hit the legal age to manage their assets. There are two popular custodial accounts; UGMA and UTMA.

(i) UGMA (Uniform Gift to Minors Act) is a custodial account that can hold gifts like stocks, mutual funds, bonds, cash, and insurance policies.

(ii) UTMA (Uniform Transfers to Minors Act) can hold all the above gifts and other assets like real estate.

If you want to get a stock gift for an adult, you can buy the shares and transfer them to their accounts. And if you want to gift stock to a child, you can consider using custodial accounts.

Certificate Of Deposits

Consider gifting a CD as a cash gift for Christmas to help your loved ones grow their savings with guaranteed interest. This gift is a type of savings account where you deposit money for a specific period. You can’t access the savings until maturity.

Moreover, CDs are excellent since they earn interest over time you lock them in the account. Also, CDs are safe as it is insured. Create a certificate of deposit for your giftee and watch the funds grow. Typically, you can deposit a fixed amount of money for three months, six months, a year, three years, etc. The longer the investment period you choose, the higher the interest your CD will earn.

Pro Tip: Financial Podcasts Subscription – A subscription to financial podcasts can inspire ongoing learning. This is one of the best financial gifts for Christmas that keeps the financial knowledge flowing.

Custodial IRA

A custodial IRA is a retirement plan that a parent or guardian can open for their minors. As the custodian, you will be in charge of the account until your child attains the age of 18—in some states, the legal age is 21. This gift can help your child achieve their future goals once they are eligible to manage their account.

Furthermore, the benefit of creating a custodial IRA account is that your child can reap from tax-free compounding. Your giftee can use the funds to pay for their college expenses or continue saving for their retirement. You can contribute any amount equivalent to the amount your child earned in the year. Pay for financial planning and investing sessions with a consultant.

This is one of the best financial gifts for Christmas, as it encourages early saving and investing.

Another way to show appreciation to your loved one this Christmas is to pay for a one-on-one session with a financial consultant. Not everyone has knowledge of money management and investing. These sessions can help your giftee learn about money and investing.

For instance, you can pay for learning sessions with a stock consultant to help your loved one understand more about stock investment. These consultation sessions can help kids understand more about money, investing, and saving.

Investing Books

Gifting a book on investing is an ideal financial gift for Christmas for anyone looking to understand their finances better.

Here are a few of Penny’s top book picks that will set your loved ones on the path to financial empowerment. Each of these books is a valuable resource, packed with insights that can help anyone – from kids to adults – understand the ins and outs of managing money, investing wisely, and building a secure financial future.

Our Top Investing Book Recommendations

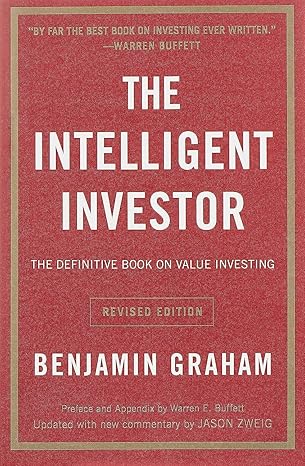

“The Intelligent Investor” by Benjamin Graham

Considered the bible of investing, Benjamin Graham’s classic teaches the fundamentals of value investing and how to minimize risks. This book is essential for anyone looking to build a strong investment foundation.

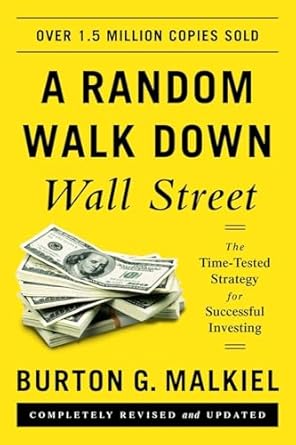

“A Random Walk Down Wall Street” by Burton G. Malkiel

Malkiel’s book presents a comprehensive overview of various investment strategies and explains the principles behind market behavior. It’s perfect for beginners and experienced investors alike.

“The Little Book Of Common Sense Investing” by John C. Bogle

John Bogle, founder of Vanguard Group, emphasizes the importance of low-cost index funds in this straightforward guide. This book is an excellent primer on building wealth through investing.

“The Simple Path To Wealth” by JL Collins

In this easy-to-read guide, Collins shares his investment philosophy focusing on the power of index funds and the importance of financial independence. A great read for those looking to simplify their investing journey.

“Investing For Dummies” by Eric Tyson

A user-friendly guide that covers all the basics of investing, including stocks, bonds, real estate, and mutual funds. This book is perfect for newcomers who want a comprehensive overview.

“You Are A Badass At Making Money” by Jen Sincero

Sincero’s book combines personal finance advice with motivational insights. It encourages readers to break through their mental barriers regarding wealth and investing.

Another thing is that you can get books on saving for young readers. One more financial gift you can get for your child this Christmas is to contribute to their 529 accounts. Securing your child’s education is the greatest gift of all time. An education savings plan can help your child pay for education-related expenses like tuition, books, and a room to stay in while studying.

What Are The Best Financial Gifts For Adults To Give This Christmas?

These gift ideas can fill your pocket in no time.

Savings Bonds

U.S. Savings Bonds are a classic financial gift for Christmas. One reason why savings bonds are the safe type of investment to give to someone is security. Also, you don’t need a ton of cash to invest in savings bonds.

Another benefit of savings bonds is that the interest you earn is tax-free. Savings bonds can help your giftee finance their education or use the money to boost their retirement plan. To gift someone with savings bonds, you need to hold an account with Treasury Direct. You can then invest in savings bonds of any amount and then transfer them to your giftee.

Cash

Sometimes, the simplest cash gifts for Christmas can be the most appreciated. Cash allows the recipient to spend or invest in whatever they need most.

People have many pressing needs, from bills to emergencies, and they will appreciate little cash to boost them. Instead of looking for an item to buy as a gift for your friend, you can consider giving them the money so that they can decide what to buy. Your loved one will appreciate cash and can use it in so many ways.

For instance, they can use it to pay for their car insurance, settle their rent, pay medical bills, go for a vacation, and much more.

Mutual Funds

If you need a perfect financial present for Christmas, then mutual funds are it. Gifting mutual funds as a financial gift for Christmas is an excellent way to encourage responsible investing.

You can buy mutual funds and transfer them to your recipient. With mutual funds, your loved one can earn and reinvest their dividends hence boosting their investment. Also, mutual funds are straightforward and also come at a lower cost.

Join The Conversation!

Tired of scrolling through endless articles and getting lost in a sea of advice? Want to be part of something bigger—like a community that actually gets you?

Join the Penny Calling Penny Facebook group, where we cut through the clutter and get straight to the good stuff!

Conclusion

So are you ready to give a financial gift that leaves a lasting impression? Keep the holiday spirit up by considering gifts that keep on giving.

Hopefully, the above financial gifts will help bring a smile to your giftee this Christmas season.

Find this helpful? Share it on Pinterest, LinkedIn and Facebook for your dear ones. Also, Sign up for our newsletter! You’ll get articles like this (and so much more!) delivered straight to your inbox.

Did you take our Reader Survey? If not, it only takes 1 minute and you can take our survey here.

FAQs

What is a good finance gift for Christmas?

A great finance gift can range from stocks, cash, or educational savings plans, depending on the recipient’s needs.

What is a good money gift for Christmas?

Cash gifts or contributions to savings accounts are practical options that allow recipients to spend according to their preferences.

What are the five gift rules for Christmas?

The five gift rules typically suggest giving one gift they want, one they need, one to wear, one to read, and one to share.

How do you wrap money for Christmas gifts?

You can creatively wrap money by placing it in a card, using decorative envelopes, or even folding it into fun shapes or ornaments.