You know how New Year’s rolls in with new opportunities and a chance to start fresh?

Well, along with that, people make these cool things called “resolutions.”

They’re like promises we make to ourselves to make the upcoming year better. And guess what?

A bunch of these resolutions are about money – you know, how to handle it better, save it, and spend it wisely.

It’s like a quest to figure out how to make those dollars go further. But here’s the thing – it doesn’t have to be all serious and dull.

We’re talking about some pretty neat and simple ways to do this without making it feel like a big, boring deal.

Just some awesome tricks to help you save up some extra cash in a way that’s easy and even fun!

Let’s dive into these cool money-saving tips for the new year!

6 Money Saving Tips For The New Year

1. Setting Financial Goals

It’s pretty cool to have a plan when it comes to money.

Imagine it like having a treasure map leading to the pot of gold at the end.

This “map” is called setting financial goals, and it’s super important for a bunch of reasons.

First off, having clear goals for your money helps you know what you’re aiming for.

It’s like having a target in a game – you know what you want to achieve.

Some goals could be saving up for something exciting like a vacation, a new game console, or even a trip to your dream destination.

Others might focus on paying off debts, like if you borrowed some cash or owe money.

There’s also the goal of investing – that’s like planting a money seed to make it grow over time.

Now, setting goals isn’t just about saying, “I want to save some money.”

Nope, it’s more like making your goals specific, measurable, and time-bound. Let’s break that down.

- Specific:

When you set a goal, make it clear and precise. Instead of saying, “I want to save money for a trip,” be specific: “I want to save $500 for a summer trip to the beach.”

- Measurable:

You should be able to track your progress. For example, if you plan to pay off a debt, you can say, “I will pay $100 every month until I clear the debt of $1,200.”

- Time-bound:

Give your goal a deadline. This helps create a sense of urgency and keeps you focused.

For instance, “I’ll save $50 per month for the next 10 months to buy that new video game.”

To make your goals achievable, start with small ones. Don’t try to save a huge amount right away.

Instead, break it into smaller, more manageable chunks. Also, make sure your goals are realistic.

If you earn $50 a month, setting a goal to save $500 a month might be a bit too much!

So, remember, clear goals give your money a purpose and direction.

They make it easier to manage and also more exciting to reach your own personal treasure at the end of the money map!

2. Creating A Budget

Managing your money is like playing a game, and having a budget is your strategy guide.

Here’s how to get started on your financial journey:-

- Understanding income and expenses:

Begin by listing all the money coming in, like your allowance, money from chores, or any other income sources. That’s your “income.”

Then, list everything you spend money on, like games, snacks, subscriptions, and other expenses. Every penny counts.

Expert Suggest: Categorize expenses into fixed (like phone bills, subscriptions) and variables (like snacks, entertainment). This helps identify where your money goes and where you might cut back.

- Crafting your budget:

Compare your income to your expenses. The goal is to ensure you’re not spending more than what you’re making.

If your expenses are higher, it’s time to think about where you can trim down.

- Proper tools for budgeting:

Consider using budgeting apps like Mint, or YNAB. These tools can streamline the budgeting process, categorize your spending, and suggest where you can save more

Pro Tip: Try the 50/30/20 rule. Allocate 50% of your income to essentials (like food, bills), 30% to fun stuff (like games, movies), and 20% to savings or paying off any debt.

- Review and revise:

Set a time, say once a month, to review your budget. This helps you see if you’re sticking to your plan or if you need to make adjustments.

Your budget isn’t fixed; it evolves as your needs and income change.

By accounting for all your income and expenses, you’re not just budgeting – you’re taking charge of your financial journey.

Remember, it’s about making your money work for you and not the other way around!

Related Blog: How To Create A Budget Plan?

3. Reducing Unnecessary Expenses

To be a money-saving ninja, it’s crucial to know where people usually spend more than they need to.

Here are some common areas of overspending and smart ways to cut back:-

- Identifying common overspending areas:

People often spend more than they should on eating out, impulse buys, unused subscriptions, or by picking brand-name products when the generic ones are just as good.

By recognizing these spending traps, you’re already taking a step towards controlling your expenses.

Expert Suggest: Studies show that excessive spending on non-essential items is a primary factor in financial instability, indicating the importance of curtailing unnecessary expenses for long-term financial health.

- Cutting back on overspending:

Cooking meals at home rather than eating out can save you a lot. It’s not just cheaper, but it’s often healthier too.

Similarly, opting for store brand or generic products can be a significant money-saver without compromising quality.

- Negotiating bills and finding cheaper alternatives:

When it comes to recurring bills like internet or subscription services, don’t be afraid to negotiate.

Give your service provider a call and see if you can get a better deal.

Also, consider exploring other service providers or cheaper alternatives that offer the same service at a lower cost.

- Curbing impulse buying:

If you tend to buy things on impulse, try making a shopping list and sticking to it.

Avoid shopping when you’re stressed or emotional, as it often leads to impulsive decisions.

Unsubscribe from promotional emails and consider disabling one-click purchasing to create a buffer between wanting and buying.

Pro Tip: When tempted to buy something impulsively, calculate how many hours you’d need to work to afford it. It often helps reconsider whether the purchase is worth the time spent earning the money.

By identifying where your money tends to slip away, negotiating bills, and curbing impulsive purchases, you’re taking substantial steps toward smarter spending and better money management.

Remember, every dollar saved contributes to your financial well-being!

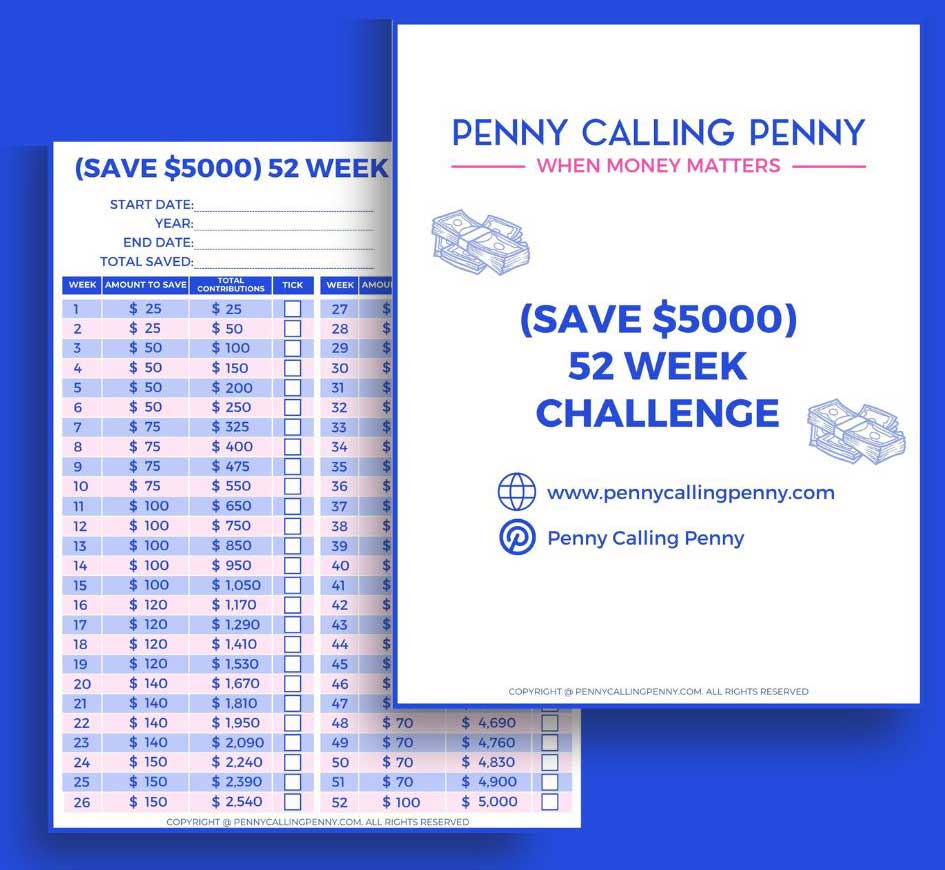

Ready to begin the 52 Week Money Saving Challenge?

(By subscribing, you agree to our terms & conditions, privacy policy, and disclaimer.)

4. Building An Emergency Fund

An emergency fund is like a financial safety cushion.

It’s there to catch you when life unexpectedly trips you up, whether it’s a sudden car repair, medical bill, or unexpected job loss.

This fund prevents you from diving into your regular savings or getting into debt when unexpected things happen.

- Starting and growing your emergency fund:

To kick things off, set a small target, like $500 or $1,000.

Save a portion of your income regularly, even if it’s just a few dollars each week.

Once you reach this initial goal, aim higher.

Work towards having three to six months’ worth of living expenses in your emergency fund.

Pro Tip: Automate your savings by setting up a direct deposit from your paycheck to your emergency fund. This way, you won’t even miss the money, and it’ll consistently grow over time.

- Where to keep your emergency fund:

Your emergency fund needs to be easily accessible, but not too easy that you spend it on non-emergencies.

Consider keeping it in a separate savings account or a money market account.

These options provide safety and accessibility in case of an emergency.

Pro Tip: Use a different bank for your emergency fund. This physical separation can prevent you from dipping into it for non-emergency expenses.

5. Investing Wisely

Investing is like planting seeds for your money to grow.

Here’s a breakdown of the basics and tips to make smart investment choices:-

- Understanding different investment options:

Investing offers various paths, like stocks, bonds, and mutual funds.

Stocks represent ownership in a company, while bonds are like loans to companies or governments, and mutual funds are a mix of various investments bundled together.

Expert Suggest: Financial advisors often suggest a diversified portfolio with a mix of investments to balance potential returns and risks.

- Choosing investments aligned with goals and risk tolerance:

Before investing, define your financial goals – whether it’s saving for retirement, buying a home, or a long-term goal.

Consider your risk tolerance too – how comfortable are you with the possibility of your investment value going up and down?

Different investments carry varying levels of risk.

- The importance of diversification:

Diversification is like not putting all your eggs in one basket. It’s spreading your money across different types of investments.

This helps reduce the risk of losing all your money if one investment doesn’t do well.

Pro Tip: Mutual funds or exchange-traded funds (ETFs) offer built-in diversification, spreading your investment across many companies or assets.

By understanding different investment options, aligning investments with goals and risk tolerance, and diversifying your portfolio, you’re setting the stage for a balanced, potentially rewarding investment journey.

Remember, investing isn’t just about making money; it’s about making your money work smarter for your future!

6. Tracking And Reviewing Progress

Keeping an eye on your financial progress is like checking the map on a road trip – it helps you stay on course and make adjustments if needed.

Here’s why and how you should track and review your financial goals:-

- The need for regular progress tracking:

Regularly tracking your financial progress helps you see if you’re heading in the right direction.

It allows you to identify what’s working and what might need tweaking.

Whether it’s saving, investing, or managing expenses, reviewing your financial situation regularly is key.

Expert Suggest: Financial experts emphasize that regular tracking and review of financial progress is crucial to maintain financial health and adjust strategies for better outcomes.

- Methods to review and adjust financial goals and strategies:

Setting a date, say once a month or quarterly, to review your progress is a good practice.

Check if you’re meeting your goals, if your budget is on track, and if your investments are performing as expected.

If not, don’t worry! It’s okay to adjust your strategies or goals to better fit your current situation.

Pro Tip: Consider creating a simple financial checklist. Include items like “savings target,” “review expenses,” and “evaluate investments.” It helps ensure you cover all the important aspects during your review.

- Encouraging persistence and motivation:

Financial journeys can have ups and downs. It’s important to stay motivated, even when things don’t go as planned.

Celebrate your small victories and stay persistent in working towards your goals.

Remember, progress is progress, no matter how small.

By consistently tracking progress, adjusting strategies, and staying motivated, you’re actively taking charge of your financial journey.

Remember, it’s not just about reaching the destination; it’s about enjoying the trip and learning along the way!

Conclusion

As we gear up for a new year, the key to a prosperous financial journey lies in a few simple yet impactful strategies.

From setting financial goals, creating budgets, and reducing unnecessary expenses to building emergency funds and making wise investments, these actions pave the way for a secure financial future.

The importance of financial discipline cannot be overstated.

By tracking progress, reviewing goals, and staying persistent, one can navigate the financial terrain with greater confidence and control.

It’s not just about making money; it’s about managing it wisely to secure a better tomorrow.

Remember, financial planning isn’t about restricting yourself but rather empowering yourself to achieve your aspirations.

It’s the roadmap to turning dreams into reality.

So, commit to the practice of these smart financial habits, and in the journey of managing your money, may the new year bring prosperity and success!

FAQs

Even small savings count! Begin by setting achievable goals, like saving a small percentage of your income. Cut back on non-essential expenses and consider setting up an automatic transfer to a savings account.

Absolutely! Try creating a budget that allocates specific amounts for different expenses, allowing room for both necessities and enjoyment. Consider cheaper alternatives, limit impulse buys, and prioritize needs over wants.

Start by learning about different investment options like mutual funds or ETFs. Diversifying your portfolio reduces risks. Consider seeking advice from financial advisors or use investment platforms with low-risk options to begin.

Celebrate milestones and small achievements. Set clear, achievable goals and remind yourself of the reasons behind your financial aspirations. Consider having an accountability partner to keep you motivated.

An emergency fund is crucial for unexpected expenses. Start by setting a target amount, even if it’s a small sum, and gradually increase it. Keep the fund in a separate, easily accessible account and consistently contribute to it.