Key Takeaways

- Investment is buying an asset to earn more money.

- Investments are made to fulfil life goals.

- Selling the asset for more price than buying out is profit on investment.

- Considering the risk level of the asset before investing is essential.

Say Hi to Miley! She is a single mother. She works as a dental hygienist in a local hospital in Austin.

She was in debt of around $20,000. But she paid monthly installments much quicker than even her lender expected.

Now, she is not only debt-free, but she is also saving for her son’s college fund along with putting aside money for her retirement.

Want to know her secret? Pretty simple, actually. In fact, just one word – INVESTMENT.

Interested in making sure that your kids go to college and you don’t starve in your retirement age? Investment has to be your solution.

So, let’s dig into the process of how to invest your money. But before that, what exactly is investment?

What Is Investment?

Remember that one lake house that your friend inherited from her grandmother?

Yes, that is the investment her grandmother made for her future.

In simple terms, investment means a physical or financial asset bought with the aim of earning an income or increasing its value over time.

Investment is done with the hope that the value of the asset would increase and the investor would get the chance to sell that financial or physical property at a higher price than bought at.

Thus, generating profits and adding up to the income of the investor.

Investment can be as small as putting a penny in your kids’ piggy banks (which, when accumulated, can be invested elsewhere) or putting money in your savings account that gets you interest, or something big like buying gold or, as said, a lake house.

Anything that will get you more money than you spent is an investment. But what about all the investing terms?

Investing Terms

We have simplified some major investing terms for you. ‘Cause investing isn’t all about complicated terms.

- Stock Markets:

They are the places where ownership shares of different stocks, companies, and organizations are sold and bought.

- Funds:

Investment baskets also termed as pooled investments, are loaded up with assets in hundreds and thousands.

- Diversification:

This is a financial strategy that helps in fanning out your investments over assets. This assists in minimizing the risk and also the subjection to market irregularity.

- Bonds:

These are the loans given by the investors to the governments or corporations. As a lender, the investor gets the interest from the money loaned as the corporation or government uses it.

- Assets:

Numerous types of investments have monetary value, and these all account for assets, the ones whose values increase over time as opposed to liabilities.

Types Of Investment

There are several types of investments, and these are common.

It is vital to understand the risks involved in each investment.

It is also important to understand which investment type is better for the short-term or long-term.

Short-Term Investment v/s Long Term Investment

- Short-Term Investment

These are the kinds of investments that an investor buys and holds for a very short period.

This period usually ranges less than three years.

If, as an investor, you wish to take out your money after three or fewer years in investments, short-term investment is for you.

It is advised that when making short-term investments, low-risk investments should be preferred.

Instances Of Short-Term Investment: Money market accounts, treasury bills, certificates of deposit and government bonds.

- Long Term Investment

These are the kinds of investments that an investor buys and holds for a very long period.

This period usually ranges more than ten years. If, as an investor, you wish to take out money after ten or more years in investments, long-term investment is for you.

It is advised that when making long-term investments, higher-risk investments could also be considered.

More time for the investment, the occasional dip in the value of the investment could recover.

Instances Of Long-Term Investment: Stocks, mutual funds, annuities and real estate among others.

Differences In Short Term And Long Term Investment

As an investor, you could make both short-term as well as long-term investments.

But there are certain differences between the both, and it is essential to keep them in mind while you decide how to invest your money.

- Risk:

The amount of risk that each investment experiences is related to the kind of investment and the strategy you choose.

Risk is basically how much value the assets can lose in the market over a certain period and exposure to the market.

Short-term has low-risk value, and long-term has high-risk value.

- Goals:

How soon you as an investor want to fulfill your goals will also create a difference.

Whether you can afford many years before your goals are fulfilled or you don’t have much time will make it short-term or long-term.

Long-term investments generally take many years before completing your goals, whereas short term might even take a few months.

- Time:

The length of time that an investment is made for or is kept as it is.

The time you as an investor take before withdrawing the investment is the time for the investment.

Long-term is usually done for ten or more years, whereas short-term is done for three years or less.

Why Is Investing Money Important?

Every individual has one or other goals in their lifetime.

And as important as it is to earn money to fulfill those goals, it is equally critical to invest that earned money wisely to double the earned amount. And fulfill those goals early and comfortably.

Your life goal can be anything like going to college, buying a house, starting your own business, or anything else; thus, how to invest money will come only after you know why investing money is important.

- Inflation

It is important to invest money so that you can save your finances from inflation.

Making investments is important in this case not to build your wealth but rather to protect your already hard-earned wealth.

- Retirement

If you wish to continue your 9 to 5 till the day you breathe your last, make no point in investing.

But if you wish to retire one day and want to make it sooner and full of comfort, invest right now.

This is the reason why you should invest. To retire without the worries of your finances.

- Big Purchase

Be it buying a new home or starting a new business, you will need money.

And it is always advised to double the money you must invest.

So, to make any big purchase, you need to have ample bucks, and investment could make it easier and easily accessible.

- Higher Education

Want your kids to study in the college of their choice? Start saving and investing right away.

You should invest money so that when you or your kids decide to join college you have enough money.

- Income

With the increasing cost of living, it would be intelligent to make money from more than one source.

And investment could be your passive income source if done right.

A rental property or interest from bonds wouldn’t hurt your bank account, would they?

Further, as mentioned, you will be compounding interest when you start investing your money.

How Do Investments Work?

The working of investments is not very complex. However, there are some types of investment which are difficult to comprehend.

But investments in very easy terms work, as putting your money in securities, which are financial and physical assets, with just one aim: to increase the money initially invested.

So, in order for you to earn profit, you need to make sure that when you are selling assets, the money you get is more than the amount you purchased the asset for.

That is, in simple terms, how investments work.

Moreover, the money you spend to purchase a property or item that helps you to produce more goods also comes under investment.

So, investment that earns you more money or gets you assets that help you get good that make money are both fruitful, and that is exactly how they work.

Investment, however, does come with risks. There is always a risk that the asset that you invest in might not bring you a return on your investment.

Like the house that you purchase disrupts during an earthquake or something else.

But that shouldn’t discourage you from investing money.

The way investment works is that it is profitable not only because of the appreciating value of your purchased assets but also holding on to them.

Investing is not only about purchasing and selling and earning an income but also about creating an income flow.

So investing is about purchasing assets that produce cash flow for the time you have. And so these investments are long-term.

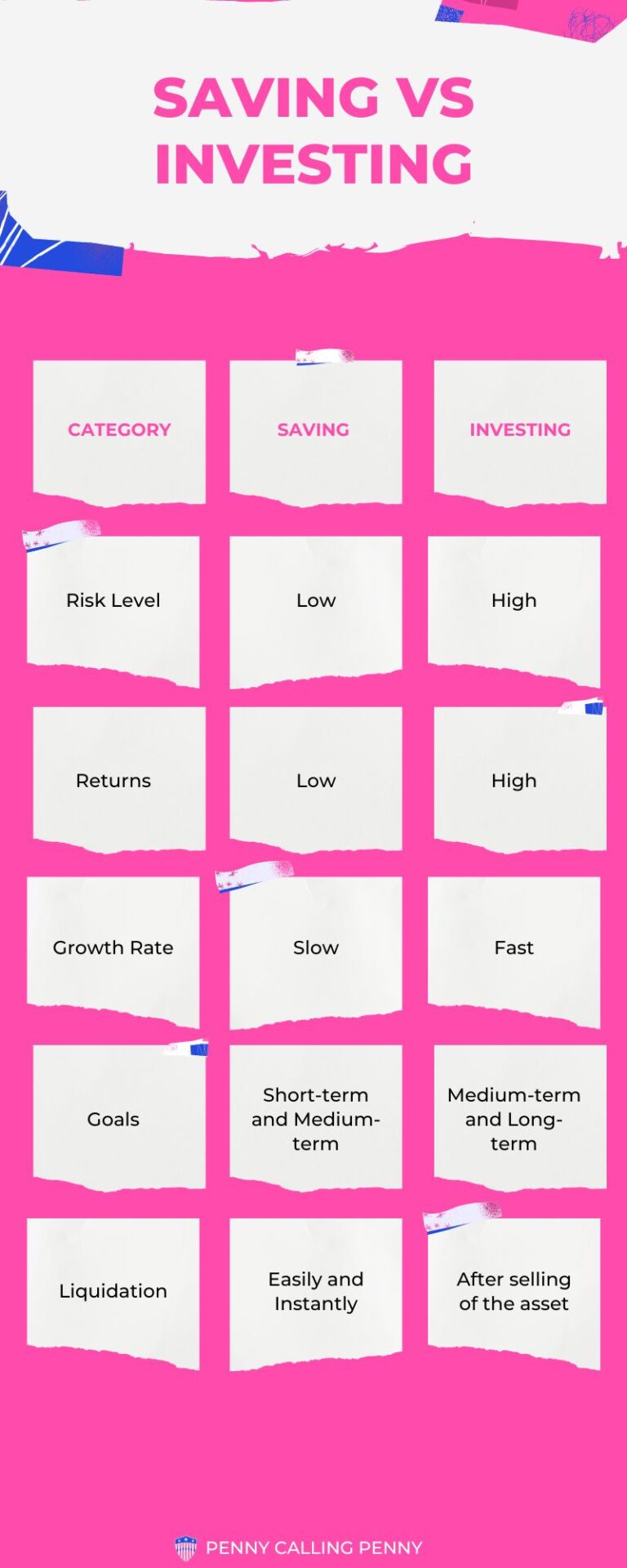

Investment is different from savings. Some people believe that it is better to save than invest.

Some may confuse them both being the practice of saving money. But there are differences between both.

Save v/s Invest

Saving and investing both have one common feature – saving extra bucks.

Except the difference which arrives when saved and invested money ought to grow in their ways.

There are other differences between saving and investing; let’s dig into them.

Fundamentals Of Investment

Investment might not necessarily be your forte, but it is not something that you can’t learn.

There are fundamentals to even nature, then how is it possible that investment doesn’t have fundamentals?

If you are able to understand the fundamentals of the investment organically, you will be able to understand how to invest money and, hence, if not a pro, at least invest wisely. These are mentioned below.

1. Investment Goals

As an investor, it is necessary to have a clear investment goal.

With a sure investment goal, it becomes easier to focus on the final financial target.

To set up the goals, it is critical to take age, investment timeframe, and risk tolerance into account.

2. Inflation

When the prices rise, inflation occurs. Inflation may lower your purchasing power.

Thus, while investing, it is one of the fundamentals to invest that cash, as compared to other investing assets, will lose its value and thus depreciate in purchasing power.

3. Compounding

As a proficient investor, it is necessary to understand the power of compounding.

So that when you get an income from your investment, you can reinvest it and thus extract the power that compounding has to offer.

After many years of investing, the compound will be more and, hence, more income.

4. Risk And Returns

The investment comes with one gospel truth – “Higher Returns, Minimal Risk.”

But the high returns often also come with higher risk and vice versa.

Hence, investing asks for withstanding fluctuations in the investment’s value.

5. Market

An investment’s value appreciation depends very much on the market, and hence, knowing about the market as one of the fundamentals of the investment is necessary.

The market has a cycle from boom to slump, and investments are affected accordingly.

Investments require this market gap to give higher returns.

6. Time

Investments seem like the way baked enough for the investor to be taken out, but in fact, it might not be.

The more time you invest, the more stable it becomes. Stability is important for an investment to meet financial goals.

7. Diversification

The more capital an investor spreads out in different numbers of investments, the more profitable it is.

By investing in different assets, growth becomes substantial, and the money isn’t bet on one asset.

Further, these investments might balance each other out.

8. Portfolio Reviews

An investor must track the progress of the investments made, thus a portfolio review.

This helps in making any changes in the portfolio if necessary.

Regular portfolio reviews also assist in achieving long-term goals better.

9. Tax And Fees

A new investor might take the help of a financial advisor or broker in some cases.

It is important to minimize the fees given to them. So that the investment could be more profitable.

Further, considering taxes while making investments is equally imperative.

Every investment comes with its tax implications and those must be checked before making any investment.

10. Losses

With heavy market fluctuations or situations like the pandemic, investments might incur huge losses.

Thus, hedging techniques and tools like ‘fence,’ ‘covered call,’ etc. can be used.

How Much Should You Invest?

It is easy to decide if you want to invest or save. But it is not easy to decide how much of your income should go for investing or saving in other cases.

Because one might think that investing more money will bring more returns and hence income but sometimes that plan can backfire.

Because as mentioned, the market is volatile, and there is no financial guarantee when it comes to investments.

Thus, it is important to decide on a particular amount that needs to be invested and how to invest it.

According to experts, there has to be a particular percentage of your after-tax income that could go to investment.

There is a window for the change in the percentage depending on income, debts, savings, and other expenses.

You could invest around 15 to 25% of your after-tax income.

You can even try the 50-30-20 budget rule for investing.

Here, 50% of the income goes to needs, 30% goes to wants, and the rest 20% could go for saving or investing or even both if feasible for you.

You can also shift between 30% of wants for 30% of saving and investing and 20% for wants.

If you believe that your income and debts wouldn’t allow you to invest even 10% of your income, you can compensate by starting early.

As early as you begin investing, you will be able to grow your money faster, even if you don’t invest much. Time horizon would compensate for it.

How To Invest Your Money?

Investing wisely will not only make sure that you reach your goals early but also help you to build your wealth.

You need to follow a certain investment style to invest wisely.

Investment Styles

- Quality Investing

This kind of investing style aims at buying stocks in a company that is profitable or financially strong.

These companies have good earnings and a stable balance sheet.

Example: Buying stocks of Johnson & Johnson will come under this style of investing.

- Growth Investing

This kind of investing style aims at buying stocks in a company that is on its road to growth.

These companies when they hit success, they bring in high returns and low dividends payouts for the investors.

Example: Buying stocks of Amazon will come under this style of investing.

- Passive Investing

This kind of investing style aims at buying assets and holding them for a long period.

It is the kind of investing which is low-risk and more feasible, although it offers lower returns than active investing.

Example: Buying shares of an ETF and holding them down will come under this style.

- Active Investing

This kind of investing style aims at buying undervalued stocks and is in an effort to beat the market.

It is the kind of investing which is difficult to find and requires a lot of time, research and skill to work.

It is high-risk and has higher returns than passive investing.

Example: Buying and selling stocks of Johnson & Johnson for profits will come under this style.

- Value Investing

This kind of investing style aims at buying undervalued stocks that may grow in value and then selling them off.

It is the kind of investing which might get a high dividend yield if done right.

Example: Buying stocks of IBM when they are of less value and selling them off for profits when the value rises will come under this style.

Thus, you go for one of the investment styles mentioned above.

Or apply a combination of these after you become familiar with the entire investment stint.

Investing Accounts

- Robo Advisors

You can start your investment journey with the help of a robo-advisor.

You wouldn’t be burdened with the responsibility to pick up an investment and make payments.

Just starting this journey, if helped by robo advisors, can let you understand the process better.

There are pre-made, diversified portfolios which can be personalized as per your risk tolerance and financial goals and automate your investing in the same.

- Online Brokerage Account

You can choose an online brokerage account and select your investments yourself.

You can research and choose the investments as per your risk tolerance and financial goals all by yourself.

Here, remember to diversify by investing in mutual funds or ETFs.

- Financial Advisor

You can go for a traditional financial advisor, you can understand investing through a hand-off approach.

They can understand your financial goals and your risk tolerance level and hence advise you on appropriate investments and even help you in managing them.

They take commission to help you manage your investments.

Strategies To Assist You To Invest

1. Start Early

You must start investing as soon as possible. This is important so that you can earn more with more compounding returns.

Further, do not shy away from investing when market conditions fluctuate.

Keeping to the course and starting to invest early can get you to build your wealth quicker.

2. Strategising

It is essential that before you decide to invest in a particular asset, you have a strategy.

This strategy will decide how much of your hard-earned income will go to which asset.

You can also get help from a financial services company like Empower, which can provide you with an investment methodology that can help you make plans for your investment better.

3. Emergencies

It is important to save some money in emergencies before you start investing.

This will help you to invest without any worries about emergencies occurring and you have all your money in investment.

4. Simplified Investment

With the digital age, it is now possible to simplify even your investments.

If you wish to invest but aren’t really versed in it or are too busy to keep track of your portfolio, you can try tools like ‘Portfolio Analyzer’ by Empower.

Tools like these help in tuning portfolios easily and with Empower even for free.

You can also automate your investments with Acorns.

5. Credit Card

If you want to invest better with more money, you must pay off your credit card debt and try to avoid using credit further.

This will help you to manage your finances better and get more money to invest.

Thus assisting you to follow your investment strategy better.

6. Avoid Tips

You may have friends who invest tell you about which new stock could be a good fit for your investment goal or even the media instructing you about the next big fund.

Avoid these tips to the extent that you are investing healthily.

You can put faith in some if you are ready to take the risk, but do not continuously keep on making changes in your portfolio.

7. Speculations

If you are starting to invest or are investing to make money, make sure that you don’t speculate.

Taking a risk with an investment opportunity is different from speculating about an investment.

You may speculate that investing in a small company might get you more returns with less money than it would with a big company.

However, this speculation might not work because small companies are not always regulated.

8. Look Out

It would help if you always looked out for different investment opportunities.

It would help if you stayed open about investing in different assets and companies.

This will help in gaining more returns from different assets.

As mentioned, even if you decide to invest in a small company, make sure to check its credibility and never invest all your money in one place.

9. Regularity

You must invest regularly. You can not invest a lot of money on a monthly or usual basis.

But investing a little sum of money is possible and will give good returns.

As you invest on a regular basis, you make sure that your investments sail through the volatile tides of the market.

10. Free Money

If you are employed and the employer does provide you with ‘free money’ in the sense that they offer employer sponsored retirement plans, you must take advantage of it.

Or else you will be missing out on a retirement investment which can benefit you.

11. Reinvest

It is profitable to reinvest your income from investment.

If you do not need your investment money urgently you can reinvest the money.

You will get compounding returns and hence earn even more in the long haul.

12. Advisors

It is okay to ask for help when you are setting foot in the investment circle.

You can take advice from financial advisors who take a certain amount of your asset as fees.

You can also go for the technologically updated Robo advisors, who charge lower fees than traditional financial advisors.

13. Scams

There are a lot of scams running in the name of investment opportunities.

Be aware of the investment options that might look real but are actually there to dupe you. Before you invest, ask as many questions as possible.

Research about the company or asset that you want to invest in. Take guidance from friends and family who are already investing.

14. Risk Tolerance

As mentioned, there is a correlation between risk and profits or returns on investment.

The more risk you are willing to take, the more money you will be putting in the chances of a higher return.

But at the same time, you may end up facing losses if the market doesn’t stay with your investment.

Whereas low risk investment comes with low returns in exchange. But losing money is also less plausible.

Risk tolerance would vary from person to person and hence investor to investor.

Best Investment Options For Beginners

As a beginner, now you shall be well versed with how to invest your money but it might be confusing which investment type to choose from.

We have prepared a list of the best investment options for beginners.

Mutual Funds

There are famous mutual funds that track indexes like the S&P 500.

These consist of about 500 of the largest companies in America.

Index funds have low fees and sometimes even zero fees.

Because of the low fees, the investors get more returns as profits, and investors could build wealth.

High Yield Savings Account

You can open this account usually through online banks.

They pay higher interest on the savings account than the usual savings account.

The good news is that you will have access to your money as you do in your average savings account.

You can make a short-term investment through this or make an emergency fund in this form.

401(k) Plan

If you are employed, your employer may be participating in 401(k) or any other retirement plan.

Do not miss this opportunity and invest in your retirement as a beginner.

Workplace retirement plans serve as a great way to save money since they are automatic and help you save consistently over time.

Certificates Of Deposit

Much like the high-yield savings account, they also get you returns on your savings account.

But they will hold down your money longer than high-yield savings accounts.

There are periods for buying CDs, like for 6 months or a year or more.

But for the period you choose, you can not access your money without paying a penalty until the CD matures.

They are a safe option for beginners in investment.

Investing Resources For Beginners

As a beginner in the investing world, it might seem a daunting task to learn about investing inside out, but we are here with some resources to help you learn about investing.

Online Courses

You can start by taking some online courses to learn the basics of investing.

You can gain knowledge about financial strategies and trading styles along with terminologies about investments coupled with thorough information about investing.

There are numerous broker offices which offer free online webinars, trading tools and courses about investing, you can join one of these.

The Financial Industry Regulatory Authority (FINRA) provides an education library for free, which has resources relating to different subjects, including investment.

App

There are many investment apps and online financial advisor websites in business today.

They all can offer help to newbies like you to understand the fundamentals of investing.

There are online financial advisors like Empower, which provides complete financial services, and Groundfloor, which offers specialized services for real estate investing.

There is also Moomoo.com, which provides you with options relating to investment, including stocks and ETFs.

Using something like this might help you in the initial stage and even after you understand investment for better returns.

IR Pages

If you are considering purchasing a stock of any particular company, go to their website and search for the Investor Relations page.

This page will give you additional information about the investment that you are about to make.

IR pages have compiled information about the financial condition of the company.

There is a high probability that the information will be hugely in the favor of the company.

However, it could still be a good resource for understanding the basics of investing in that company when you are just beginning to invest.

News

After you start investing, you might be interested in buying stocks of your favorite companies. But before you do that, always look at the news.

News can be your biggest resource to know about what is happening in the market.

You can add stocks, funds and various investments to a watchlist every evening after work.

There are free resources like Yahoo Finance and Google Finance, which assist you with virtual and real-life trading.

You can get financial news, including stock price charts, portfolio builders, watchlists, stock information and historical data.

You can also grow your money by investing in precious metals, and to gain knowledge about the same, you can visit sites like Kitco and more.

They give information about spot prices of gold, stock updates and charts, etc.

Books On Investing

You can learn basics about stocks, investing and other important terms relating to investing.

You can get help from various books that are available for investment. One of them is “Investing QuickStart Guide“, Authored by Ted D. Snow.

It, in its new edition, also has information on real estate and tax liabilities.

Content

There are various sites which offer crowdsourced content.

This means people from different walks of life, professions, and cities write about their experiences, and you can read the content and understand investing, the stock market and other financial problems.

There are sites specifically curated for investment.

A quick Google search will get you the desired sites.

Conclusion

Investing is a task that might take you on a ride so high that you would feel like staying there all the time.

But remember, what goes up will come down. And such is the case with prices of investments as well.

So whenever you invest in whichever asset, make sure you are aware of all the kinds of risks involved and have full information and knowledge about the asset before putting down the payment.

As you grow as an investor, your experience will guide you, and you will be earning well in no time.

And how to invest money will be a question to which you will now have an answer.

You May Also Like: How To Invest In Your 30s? The Ultimate Guide

FAQs

As a beginner, you can start investing by understanding the basics of investing and then investing in assets like Certificates of Deposit, Mutual Funds, 401(k) Plans and High Yield Savings Accounts.

The safest investment for a beginner can be a High Yielding Savings account. It is low on risk and gives good returns.

Experts say that you can invest around 15 to 25% of your after-tax income in various assets.

It is more than enough if you have $100 as your first-time investment. You can put these dollars in different assets to diversify your portfolio. Depending on the asset you invest in, your returns could be good.